Strategy’s European Preferred Share Faces Adoption Challenges

Strategy (MSTR) launched its first non-U.S. perpetual preferred product, Stream (STRE), in November, targeting investors across the European Economic Area (EEA). The offering was designed as a European counterpart to Stretch (STRC), the company’s high-yield, money-market-style preferred share.

STRE carried a stated value of €100 ($115) per share, offered a 10% annual dividend, and ranked above common equity in the capital structure. While the product theoretically appealed to investors, Strategy ultimately raised $715 million by pricing STRE at a 20% discount to €80 per share, reflecting subdued demand and challenging market conditions.

Since issuance, STRE has struggled to gain traction. Public updates from Strategy have been sparse, and the product has been removed from the company’s dashboard.

Barriers to Adoption

Khing Oei, founder and CEO of the Netherlands-based bitcoin treasury company Treasury, points to structural issues limiting STRE’s uptake. Access is a primary hurdle: STRE is listed on Luxembourg’s Euro MTF, a venue with limited distribution. Major brokers, including Interactive Brokers, do not support the instrument, leaving retail investors largely unable to trade it.

Transparency is another challenge. Historical pricing and liquidity data are scarce, making it difficult for investors to evaluate performance. TradingView currently reports a $39 billion market capitalization for STRE, but with trading volume of just 1,300 shares, highlighting limited market activity.

Looking Ahead

Oei suggests that relisting STRE on alternative European venues could improve adoption. Markets in the Netherlands, for instance, offer stronger distribution, deeper market making, tighter bid-ask spreads, and broader retail access—conditions more conducive to growth.

It remains unclear whether Strategy will commit to expanding its European presence or continue focusing on the U.S., where it already offers four perpetual preferred share products. Executive chairman Michael Saylor has previously downplayed expansion into markets such as Japan, leaving Europe’s potential largely untapped.

More Stories

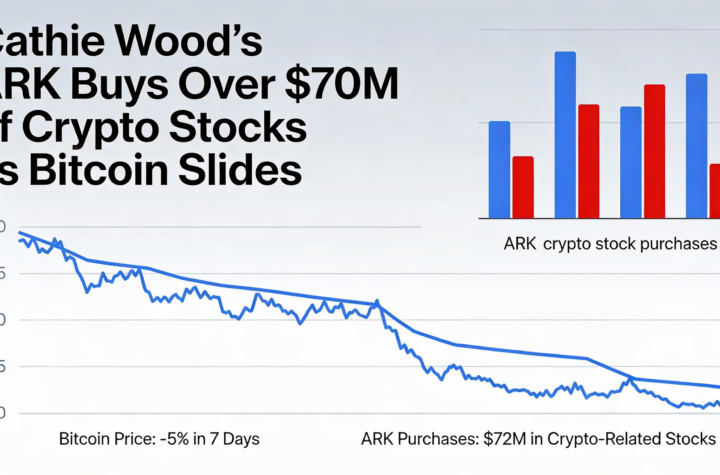

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO