Technical traders say XRP is forming a classic volatility compression pattern, with $1.39 emerging as key support and $1.44 acting as the immediate resistance barrier. A clean break above that level could expose upside targets at $1.50 and $1.62.

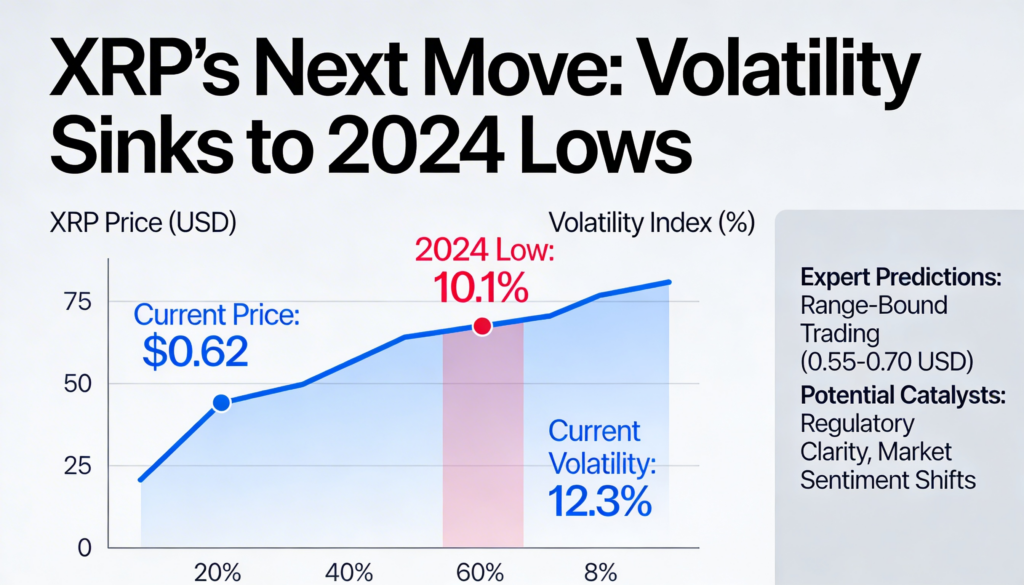

XRP was trading near $1.42 as volatility cooled to levels last seen ahead of a major rally in 2024, fueling speculation that the broader downtrend may be losing steam.

Market context

The token remains roughly 61% below its all-time high amid the current stretch of market weakness. However, recent price action suggests the pace of declines is slowing. Instead of sharp selloffs, XRP has shifted into tighter consolidation, with smaller intraday moves replacing heavy directional pressure.

Historical volatility has slipped to 96 — matching readings from June 2024, when XRP established a base before advancing into November. The similarity in volatility structure has prompted some analysts to argue that another accumulation phase may be underway.

Others point to earlier cycle behavior, including the extended sideways range that preceded the 2017 breakout, as a potential roadmap.

Recent price action

- XRP dipped 0.14% to $1.42

- Support around $1.39 was tested and held

- Volume jumped approximately 94% above average during the decline

- The rebound stalled between $1.428 and $1.431

Technical outlook

The session’s inflection point came when XRP fell to $1.3915 on strong volume before stabilizing. The bounce retraced 38.2% of the prior move, but momentum faded as price approached the $1.44 zone — which aligns with the daily pivot and short-term resistance.

While the structure remains cautious below $1.44–$1.45, the firm defense of $1.39 suggests selling pressure may be easing. Lower volume during the consolidation phase signals tightening conditions rather than renewed distribution.

What comes next?

Traders view the current setup as a volatility squeeze, where narrowing price ranges often precede expansion.

- A decisive move above $1.44 would shift focus to $1.50 and potentially $1.62.

- A break below $1.39 would increase downside risk toward $1.35.

With volatility near cycle lows, market participants suggest the next significant move may depend less on immediate direction and more on when the current compression resolves into a broader breakout.

More Stories

Fears of a Blue Owl funding squeeze are stirring memories of 2008, with speculation that the turmoil may set the stage for bitcoin’s next rally.

Bitcoin holds firm near $68,000 despite new Trump tariffs, with altcoins driving a modest recovery.

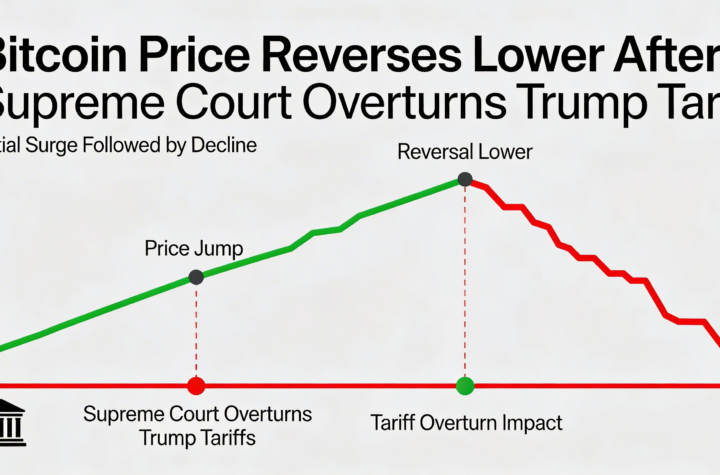

Bitcoin rallies briefly, then slides as the Supreme Court strikes down Trump-era tariffs.