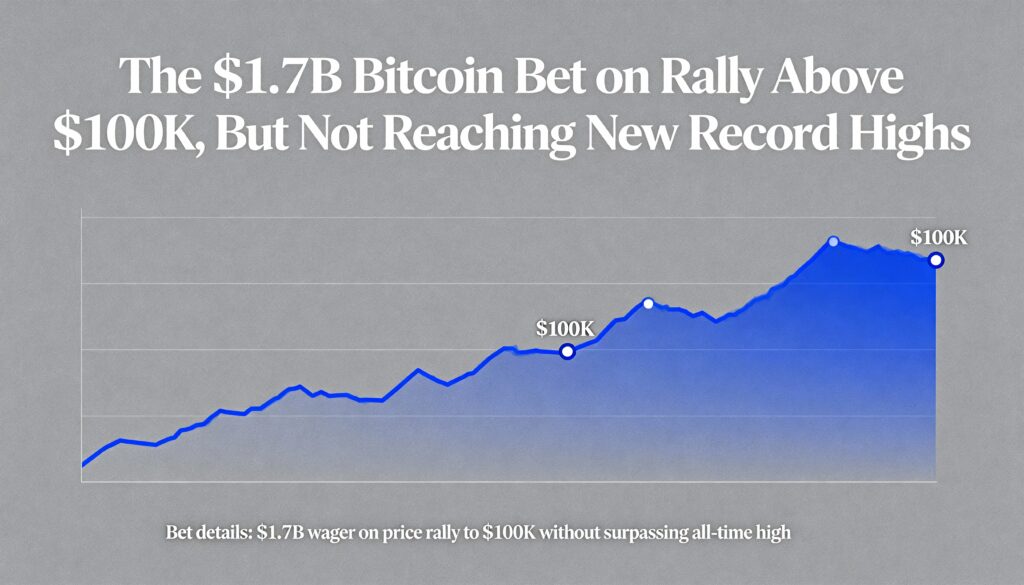

A major options play executed Monday shows a trader is positioning for Bitcoin to grind higher into year-end—aiming for a move above $100,000, but not a return to record territory.

Bitcoin BTC$90,772.41 has recovered to about $88,000, staging a notable rebound from last week’s dip near $80,000. The recovery has been fueled in part by rising expectations of a December 25-basis-point rate cut, though institutional demand through spot ETFs has not followed suit. The 11 spot Bitcoin ETFs collectively logged $151 million in outflows on Monday, according to SoSoValue.

Despite muted ETF flows, a block trader initiated a hefty 20,000-BTC call condor—a $1.76 billion notional bet—anticipating a controlled rally above six figures. Deribit confirmed the trade on X, noting:

“A long-dated 100k/106k/112k/118k call condor was lifted for Dec ’25—reflecting a structured bullish view for BTC to reach the $100K–$118K zone, not blow past it.”

The four-legged strategy uses calls at different strike prices: long $100K, short $106K and $112K, and long $118K. The payoff peaks if Bitcoin ends the year between $106K and $112K, signaling confidence in further upside but capped expectations above $118K. This positioning implies the trader does not expect Bitcoin to test new all-time highs above $126,000 this year.

Block trades—large, privately negotiated transactions executed off-exchange—are tools frequently used by institutions to minimize market impact. Monday’s sizable condor position shows advanced traders are increasingly making precise, scenario-based bets on how far Bitcoin’s rebound can realistically extend

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin