XRP Pulls Back After Resistance Rejection as Institutional Selling Surges

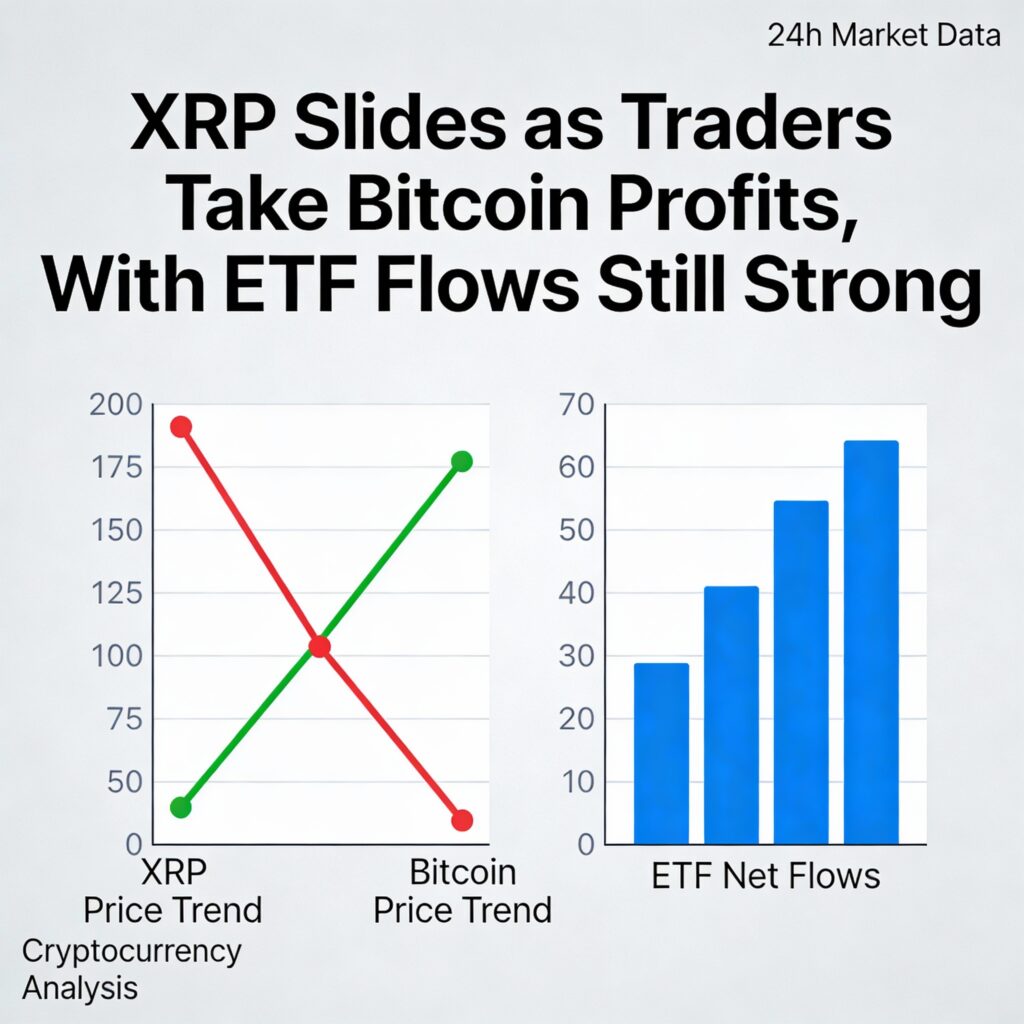

XRP faced a decisive rejection near $2.09–$2.10 on Wednesday, slipping back to the $2.00 psychological level as institutional flows surged 54% above the weekly average, signaling strategic distribution rather than retail panic. Despite the failed breakout, ETF inflows continue to quietly tighten supply under the surface.

What to Know

- XRP dropped 4.3% from $2.09 to $2.00, underperforming the broader crypto market by roughly 1%.

- A peak intraday volume of 172.8 million tokens—205% above the daily average—occurred around $2.08, confirming the breakout failure.

- The session’s 54% above-average volume suggests institutional distribution rather than emotional retail selling.

- Exchange balances fell from 3.95B to 2.6B tokens over the past 60 days, compressing supply even as price failed to hold the breakout. XRP now trades within a narrowing multi-month triangle, creating an asymmetric setup.

Market Context

- U.S. spot XRP ETFs saw over $170 million in weekly inflows, continuing a streak of zero outflows.

- Heavy selling persists in the $2.09–$2.10 band, where XRP has failed multiple times.

- Market makers had flagged strong distribution pressure above $2.10 ahead of Wednesday’s move.

- Despite ETF support, XRP lagged the broader crypto market as the CD5 index fell 3.1%, indicating token-specific weakness.

Price Action Snapshot

- Intraday range: 5.4%, driven by resistance rejection and high-volatility unwind

- Peak volume: 172.8M at 19:00 UTC (205% above daily average)

- Resistance: Multiple rejections at $2.08–$2.10

- Late-session support: Higher lows around $1.999–$2.005

- Relative performance: Lagged broader crypto by ~1%

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin