Dogecoin Stabilizes Near $0.1372 After Sharp Selloff

Dogecoin (DOGE) appears to have exhausted immediate downside momentum, finding short-term support at $0.1372 following a sharp breakdown.

Market Context

Crypto markets turned defensive after the Federal Reserve cut rates by 25 basis points to a 3.5%–3.75% range. While the cut was largely expected, internal Fed divisions and renewed inflation concerns spooked risk assets, triggering broad selloffs. Meme coins, which tend to be more volatile during macro shocks, underperformed as Bitcoin fell below $90,000 over the weekend. DOGE faced additional pressure as traders reduced exposure amid heightened volatility, despite no negative developments specific to the token.

Technical Overview

DOGE broke the critical $0.1407 support at 15:00 UTC on Dec. 12, accompanied by a 348% surge in volume, indicating forced liquidation. The token hit a session low of $0.1372, where selling pressure eased. Subsequent lower-volume candles and a rebound with higher lows completed a V-shaped reversal, signaling potential stabilization.

Price Action

DOGE dropped 2.6% during the session, trading between $0.1413 and $0.1376, a $0.0064 range reflecting 4.6% intraday volatility. After bottoming at $0.1372, the token stabilized and closed near $0.1376.

More Stories

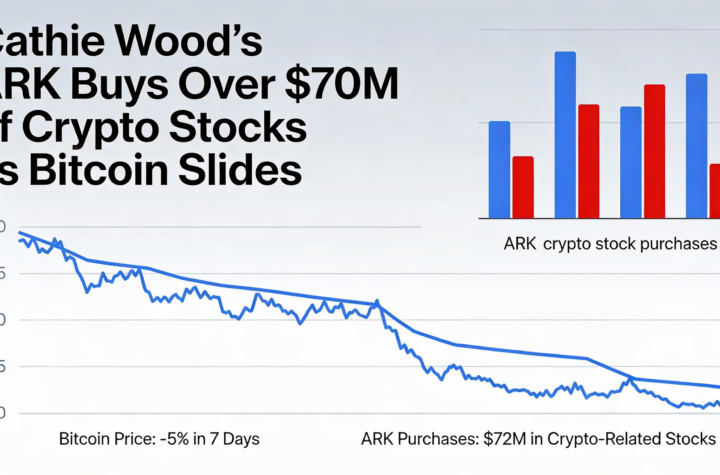

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO