Strategy Raises STRC Dividend to 10.75% as Stock Trades Below Par

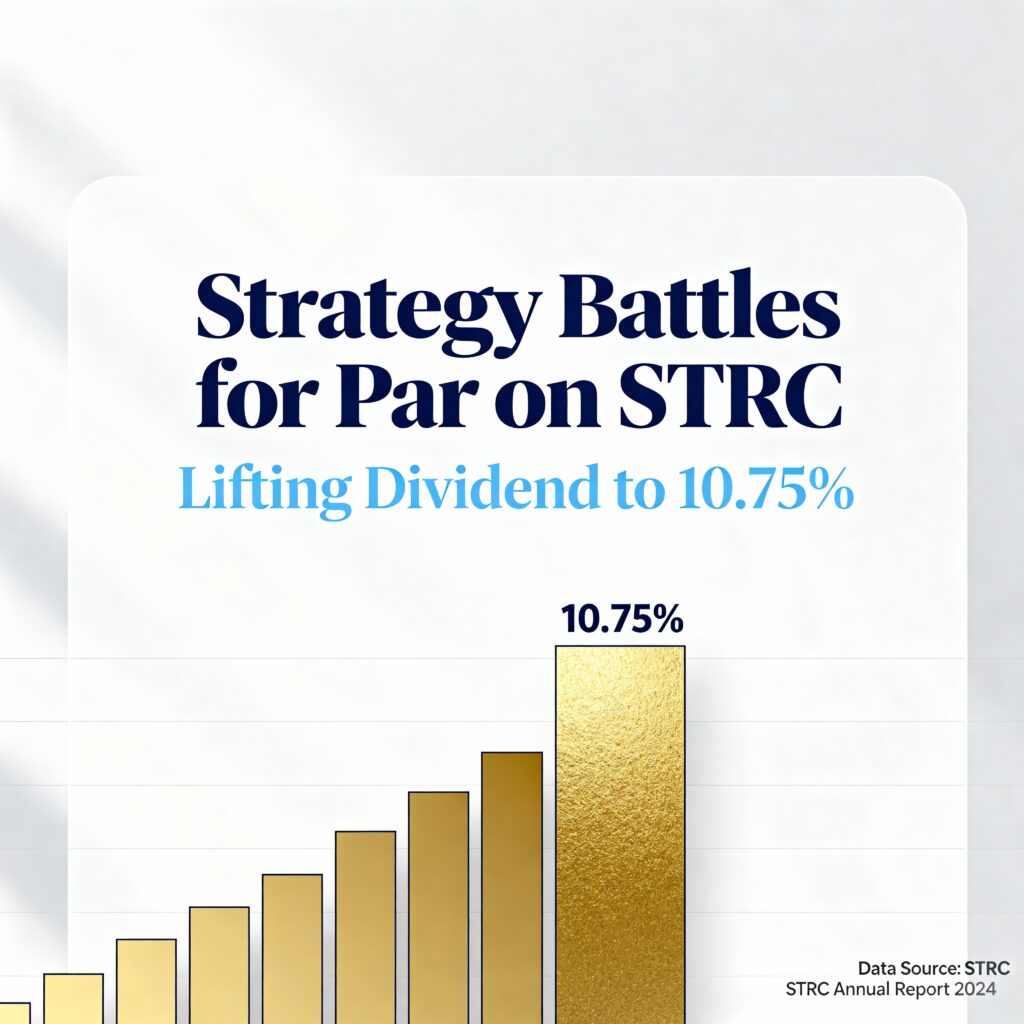

Strategy (MSTR) on Monday announced a 25-basis-point increase in the dividend rate for its STRC preferred series, lifting it to 10.75%. This is the fourth increase since the IPO in late July.

STRC, nicknamed “Stretch,” is a perpetual preferred stock offering short-duration exposure with a high yield. Dividends are paid monthly in cash, with rates adjusted to keep the stock trading near its $100 par value and reduce price volatility.

Originally priced at $90 with a 9% dividend, STRC received two prior hikes to 10.25% but still fell short of par. A third increase briefly pushed the price to $100, but market declines in bitcoin and Strategy’s common stock caused STRC to drop to around $90 in November, triggering the latest adjustment. At press time, STRC traded at $98.43.

The dividend hike comes alongside a $1.44 billion cash reserve designated for funding perpetual preferred dividends. Total annualized obligations across all perpetual preferred shares amount to roughly $800 million. With $59 billion in bitcoin reserves, the company reports 74 years of dividend coverage, though near-term payouts will rely primarily on the cash buffer.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin