Spot Solana (SOL) exchange-traded funds continued to attract steady capital on Wednesday, extending their inflow streak to 17 consecutive days since launching on Oct. 28 — a period during which bitcoin and ether ETFs have faced substantial withdrawals.

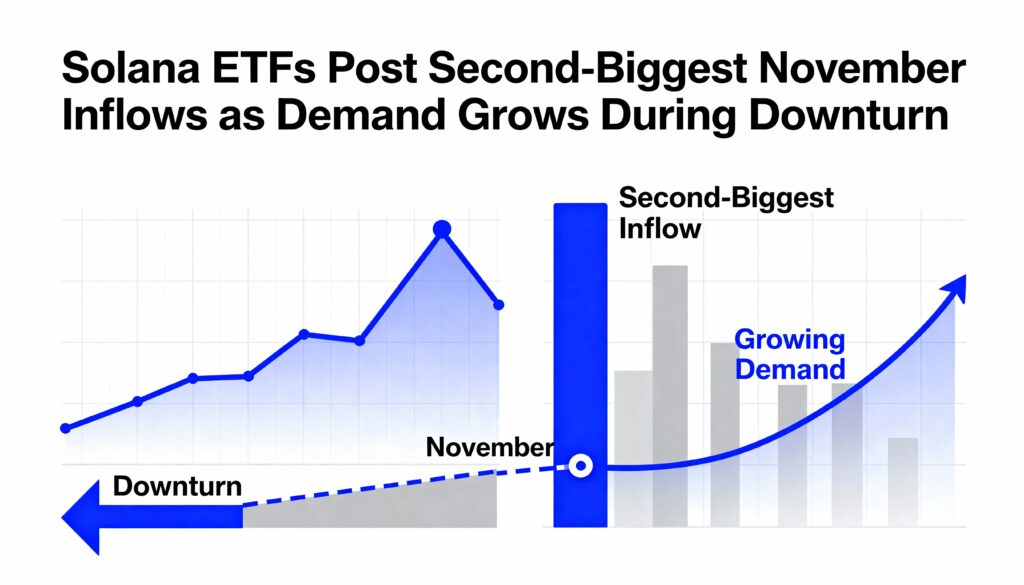

According to Farside data, U.S. spot SOL ETFs brought in $48.5 million midweek, lifting total net inflows to $476 million. The latest addition marked the second-largest daily inflow for Solana products this month.

The consistent momentum — now the longest run of uninterrupted positive flows among crypto ETFs this year — highlights a growing investor appetite for Solana even as demand for bitcoin and ether products weakens. In November, bitcoin ETFs have seen an estimated $2.96 billion in net outflows, while ether ETFs have lost about $107 million.

Bitwise’s BSOL was the top contributor on Wednesday with $35.9 million in new allocations. Grayscale’s GSOL followed with $12.6 million, while Fidelity’s FSOL and VanEck’s VSOL posted smaller inflows.

The resilience of Solana ETF flows comes during a broader market downturn. The CoinDesk 20 Index (CD20) has declined 12% over the past week, yet investors continue to increase their exposure to SOL despite the pullback.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin