Coinbase Sees Crypto Recovery Ahead on Improving Liquidity and Rising Fed Rate-Cut Odds

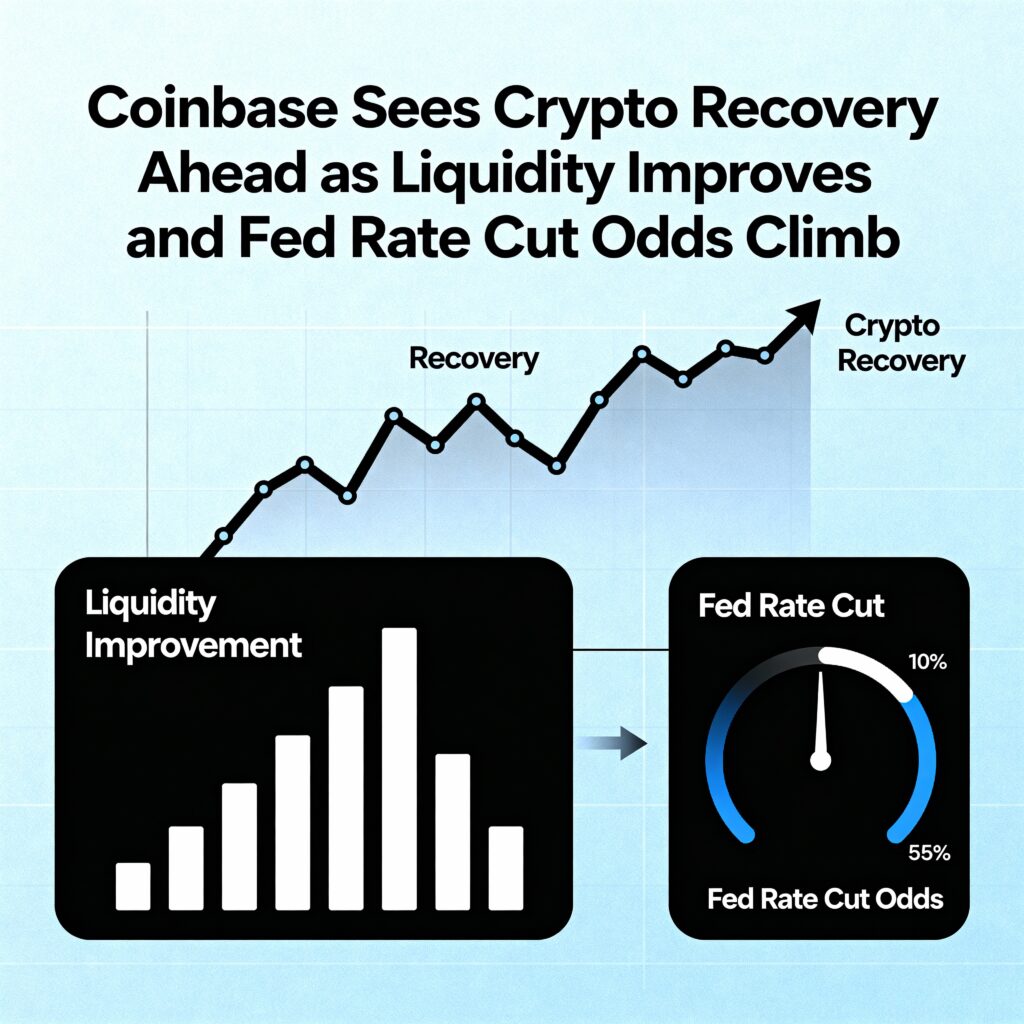

Coinbase Institutional expects a potential crypto rebound in December, citing better liquidity conditions and shifting macroeconomic factors that could favor risk assets like bitcoin.

In a Dec. 6 market note, the firm highlighted the growing likelihood of a Federal Reserve rate cut next week—93% on Polymarket and 86% on CME FedWatch—as a key driver for the market recovery.

Liquidity is also improving, according to Coinbase’s internal M2 index, which tracks monetary flows affecting asset prices. The firm had previously predicted a weak November followed by a rebound, based on similar metrics.

Other potential tailwinds include the ongoing AI bubble and a weaker U.S. dollar, both of which could provide additional support.

Bitcoin, while lower on the week, bounced from recent lows, likely aided by institutional moves such as Vanguard’s crypto ETF policy reversal and Bank of America permitting wealth advisers to allocate up to 4% of portfolios to crypto.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin