XRP Leads Crypto Surge as Bitcoin Nears $95,000, Crypto Stocks Jump

Crypto markets rallied sharply on Monday, with XRP leading the charge as Bitcoin climbed to a six-week high. Bitcoin (BTC) gained more than 3%, reaching $94,400 — its largest single-day percentage increase in over a month — edging closer to the $95,000 level that analysts see as crucial for sustaining momentum.

XRP (XRP) outperformed, rising 9% to just below $2.32 after breaking key resistance overnight, marking its strongest level since mid-November.

Crypto Stocks See Broad Gains

Investor sentiment also lifted crypto-related stocks after a challenging 2025. Coinbase (COIN), boosted by a “buy” rating from Goldman Sachs, jumped nearly 9%, while MicroStrategy (MSTR) and Robinhood (HOOD) gained 5% and 6%, respectively.

Smaller players posted even larger moves: Bakkt (BKKT) soared 30%, Figure (FIGR) added 20%, and Bitcoin miner Hut 8 (HUT), which expanded into AI infrastructure last year, climbed 15% to nearly $60 per share. Long-term investors may now target the stock’s split-adjusted 2021 high of $76.

Wider Market Trends

U.S. equities also rose, with the Dow leading at a 1.4% gain. The Nasdaq and S&P 500 were up 0.7%. Precious metals showed volatility with upward momentum, as silver jumped 7% and gold rose 3%.

Outlook for Bitcoin

Despite a 6% decline in 2025, Bitcoin may rebound in 2026, according to Lukman Otunuga, senior market analyst at FXTM. Lower interest rates and reduced active BTC supply — driven by long-term holders keeping coins off exchanges — could support prices.

Still, challenges remain. New U.S. tax reporting rules could limit retail participation, while regulatory scrutiny of crypto-heavy firms remains a concern. Otunuga notes that surpassing $100,000 could reignite record-high ambitions, while a fall below that level might expose Bitcoin to further declines, with support near $77,500 and $54,000.

More Stories

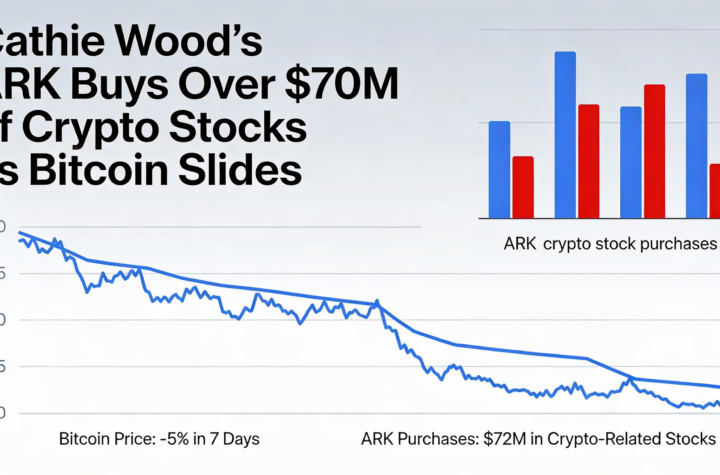

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO