Bitcoin (BTC $87,557.18) rebounded modestly Friday morning in U.S. trading following a 10% overnight sell-off, as dovish remarks from New York Fed President John Williams boosted expectations for a Federal Reserve rate cut in December.

“I still see room for a further adjustment in the near term to the target range for the federal-funds rate to move the stance of policy closer to the range of neutral,” Williams told the Wall Street Journal. “Looking ahead, it is imperative to restore inflation to our 2% longer-run goal on a sustained basis. It is equally important to do so without creating undue risks to our maximum employment goal.”

Williams’ comments stood in contrast to Fed hawk Cleveland Fed President Beth Hammack, who emphasized inflation and a potentially bubbly stock market, while largely downplaying labor market concerns.

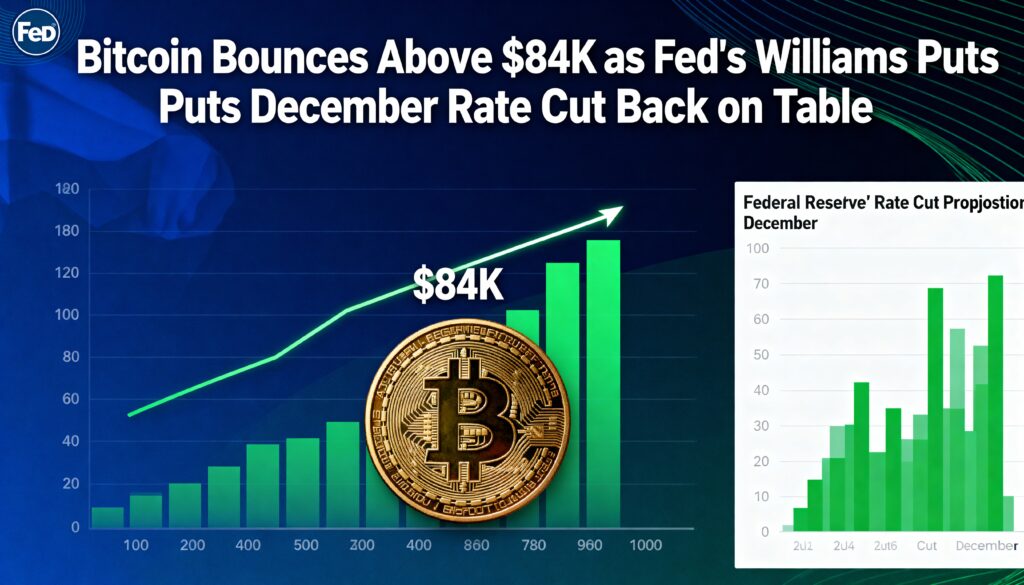

Markets reacted quickly: Bitcoin jumped from around $81,000 to above $84,000, and was trading near $83,500 at press time, still down 9.5% over 24 hours. Nasdaq 100 futures also rose 0.35%, from roughly flat before Williams’ statements.

Expectations for a 25 basis point Fed rate cut in December surged to 70%, up from 39% a day earlier, according to the CME FedWatch Tool

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin