Bitcoin Slides as Asia-Driven Selling Hits Crypto Markets

Bitcoin gave back last week’s gains as Asia-led selling weighed on the crypto market, compounded by declines in U.S. equity futures. BTC traded at $90,258, wiping out its rally from $98,000.

The downturn accelerated during the Asia session, starting around 01:15 UTC and stabilizing near 07:00 UTC. Privacy-focused coins were among the hardest hit, with Monero (XMR) down 9% to $515 and Dash (DASH) falling 3% to $69.44, reflecting cooling trader interest after a strong start to the year.

The selloff in crypto tracked moves in U.S. equities. Nasdaq 100 futures fell more than 1.9% since Sunday evening, while S&P 500 futures dropped 1.6%. Analysts point to continued trade tensions between the U.S. and EU over Greenland as a key driver of risk-off sentiment.

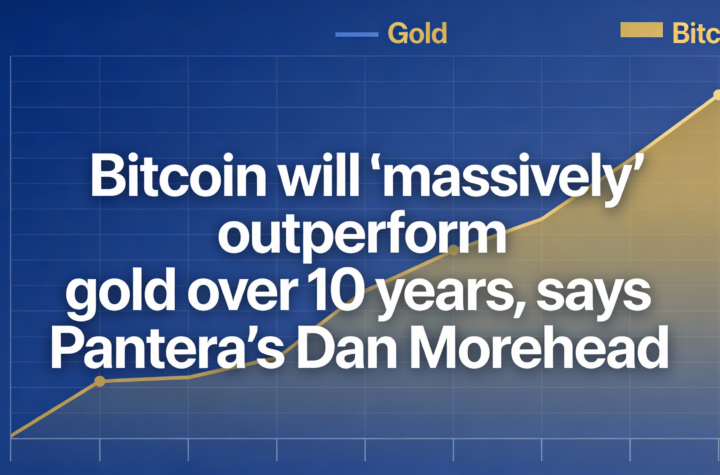

Safe-haven assets extended gains, with gold and silver climbing to record highs.

Derivatives and Market Positioning

- Over $360 million in crypto futures positions were liquidated over 24 hours, mostly from long bets.

- Bitcoin’s 30-day implied volatility (BVIV) rose to 42% from 39.7%, signaling renewed demand for options and hedging strategies.

- U.S. Treasury volatility ticked up slightly but remains far below November levels, suggesting potential risk aversion if volatility rises further.

- DOGE, ZEC, and ADA led declines in futures open interest, indicating capital outflows, while BTC futures open interest remained steady.

- Funding rates for most major tokens remain positive, pointing to a bullish bias, though ZEC and TRX show deep negative funding, reflecting heavy short positioning.

- On Deribit, put options for BTC and Ether (ETH $3,000.50) are priced higher than calls, reflecting persistent downside concerns. On decentralized platform Derive, traders price a 30% chance of BTC falling below $80,000.

Altcoins Face Pressure

Lower-liquidity altcoins underperformed Bitcoin, with Ethereum and Solana (SOL $130.22) down over 3%. DeFi tokens like AERO and SKY fell more than 5.5% in 24 hours.

The memecoin sector also slumped, with the CoinDesk Memecoin Index (CDMEME) down 3.91%, underperforming other benchmarks.

Traders are closely watching Bitcoin’s next move. Consolidation between $85,000 and $95,000 could stabilize altcoins, while a sustained drop below $85,000 could trigger heavy losses, as liquidity has yet to recover from October’s $19 billion liquidation cascade.

More Stories

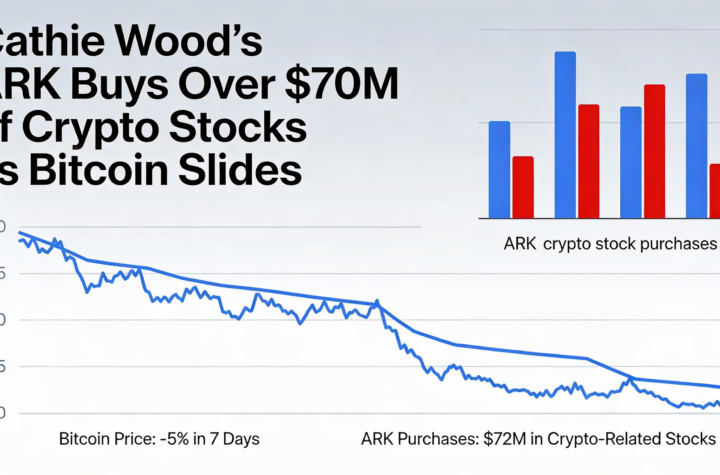

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO