Crypto Markets Swing as Softer U.S. Inflation Data Sparks Volatility

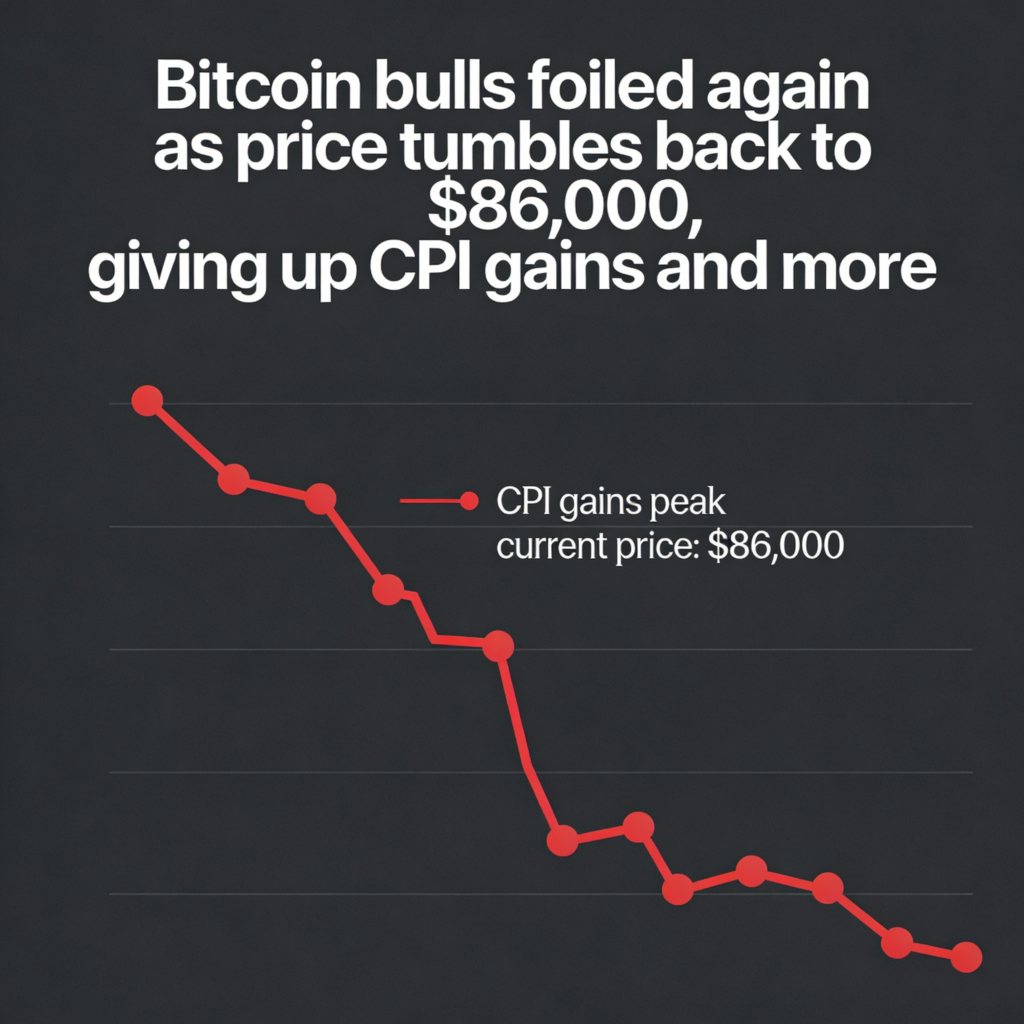

Crypto markets staged an early rally Thursday following weaker-than-expected U.S. inflation data, only to reverse sharply within hours. Bitcoin (BTC) climbed to $89,300 before tumbling to $85,500, and was trading around $86,000 at press time, down 0.8% over 24 hours. The Nasdaq fell roughly 2% from session highs but remained up 1.7% overall.

The November Consumer Price Index showed headline inflation cooling to 2.7% from October’s 3%, prompting some traders to anticipate a possible Federal Reserve rate cut in January—a scenario typically supportive for risk assets like crypto.

Skeptics, however, raised concerns over the accuracy of the data. Economist Omair Sharif noted that the BLS zeroed out rent and owner’s equivalent rent (OER) in October, which could artificially lower year-over-year CPI readings through April. WSJ reporter Nick Timiraos called the move “totally inexcusable,” criticizing the BLS for the methodology.

Market expectations have reflected this skepticism. Odds of a January rate cut remain at roughly 24%, showing little change despite the softer CPI print.

Bitcoin Stays Rangebound, Ether Shows More Hedging

Crypto options activity points to a range-bound outlook for BTC and a more cautious stance for ether (ETH $2,981.53). Bitcoin traders are selling downside protection below $85,000 while capping upside exposure above $100,000, signaling confidence in near-term support but limited expectation for a breakout, according to Wintermute’s OTC desk.

Ether options tell a different story. Support appears to be forming around $2,700–$2,800, but upside calls above $3,100 are being sold aggressively, suggesting traders are prioritizing protection over betting on strong gains.

More Stories

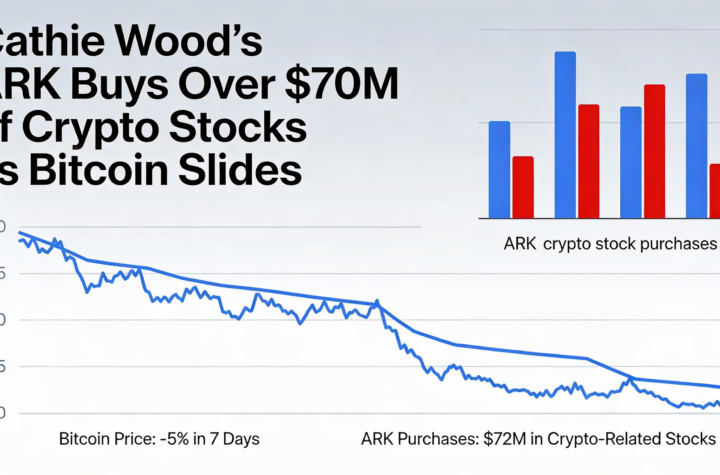

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO