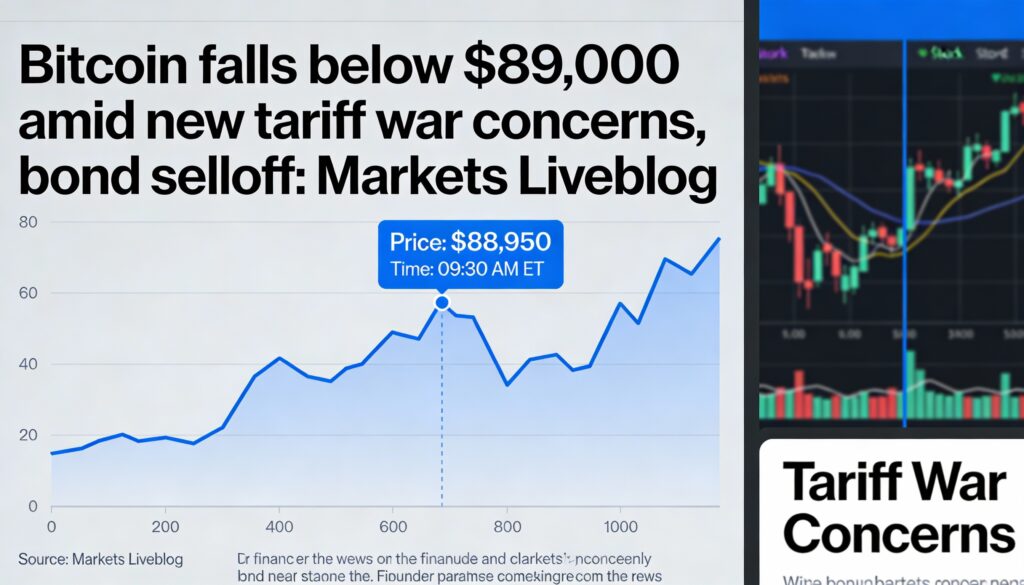

Bitcoin Falls Below $90K as Global Risk-Off Sentiment Hits Markets

Bitcoin dropped below $90,000 on Tuesday as traders sold risk assets amid turmoil in Japan’s government bond market and renewed U.S. tariff threats against Europe. Ether (ETH) fell below $3,000, down more than 6% in 24 hours, marking its weakest point since early January.

The selloff erased much of Bitcoin’s 2026 gains. BTC hovered around $88,400 at one stage—the lowest since January 2—while the CoinDesk 20 Index fell over 5%. Bitcoin’s market dominance climbed to 59.8%, highlighting altcoin weakness.

Veteran trader Peter Brandt flagged the potential for BTC to drop to $58,000–$62,000 within two weeks, while options data suggests roughly a 30% chance Bitcoin could fall below $80,000 by June.

Crypto-linked equities also declined: Strategy (MSTR) lost 7.8%, BitMine Immersion (BMNR) fell 9.5%, Coinbase (COIN) dropped 5.5%, and Circle (CRCL) fell 7.5%. Privacy coins Monero (XMR) and Dash (DASH) tumbled 11.6% and 8%, respectively. DeFi protocols showed resilience, with total value locked continuing to trend upward.

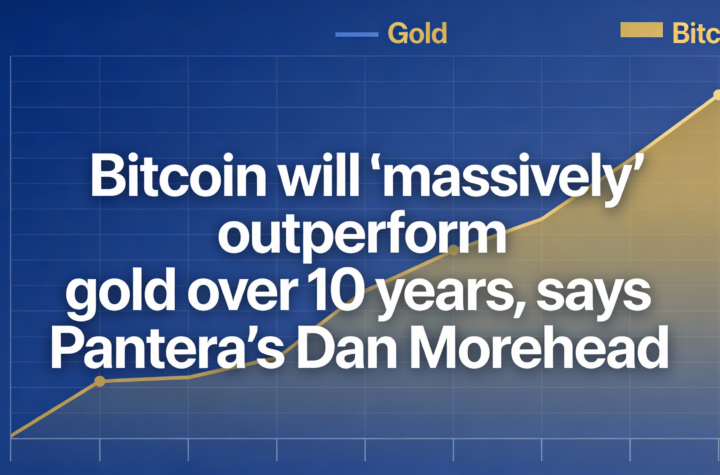

Global equities mirrored the risk-off mood, with the S&P 500 down 2%, Nasdaq 100 off nearly 2%, the Nikkei down 2.5%, and Germany’s DAX down 1%. Safe-haven metals surged, with gold up 3% and silver rising 7% to record highs.

Market observers cited tight liquidity and geopolitical uncertainty as key drivers. Galaxy Digital’s Mike Novogratz said Bitcoin must surpass $100,000 to resume its upward trajectory, while BitMEX co-founder Arthur Hayes warned of potential spillover from Japan’s bond market into U.S. Treasuries.

Trading data showed $486 million in long positions liquidated on Tuesday. Open interest in Bitcoin derivatives rose slightly, indicating shorting, while Ether’s open interest fell, pointing to spot-market selling.

Despite broad losses, some projects outperformed: Canton Network (CC) surged 18%, ARC jumped 30%, and Pumpfun (PUMP) gained 4%. Bullish (BLSH), CoinDesk’s parent company, rose over 1%.

More Stories

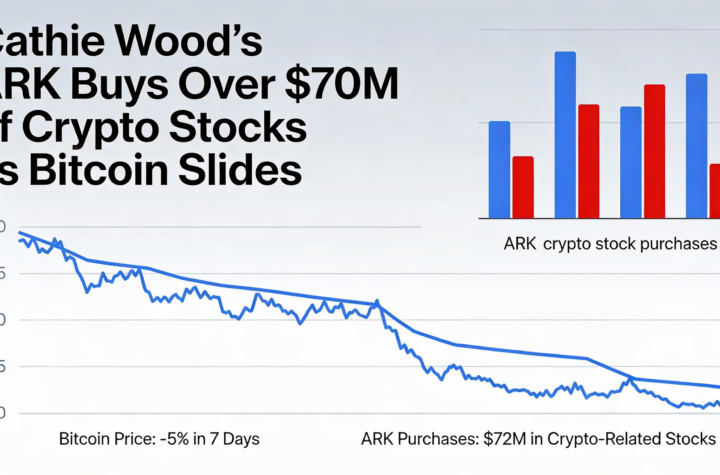

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO