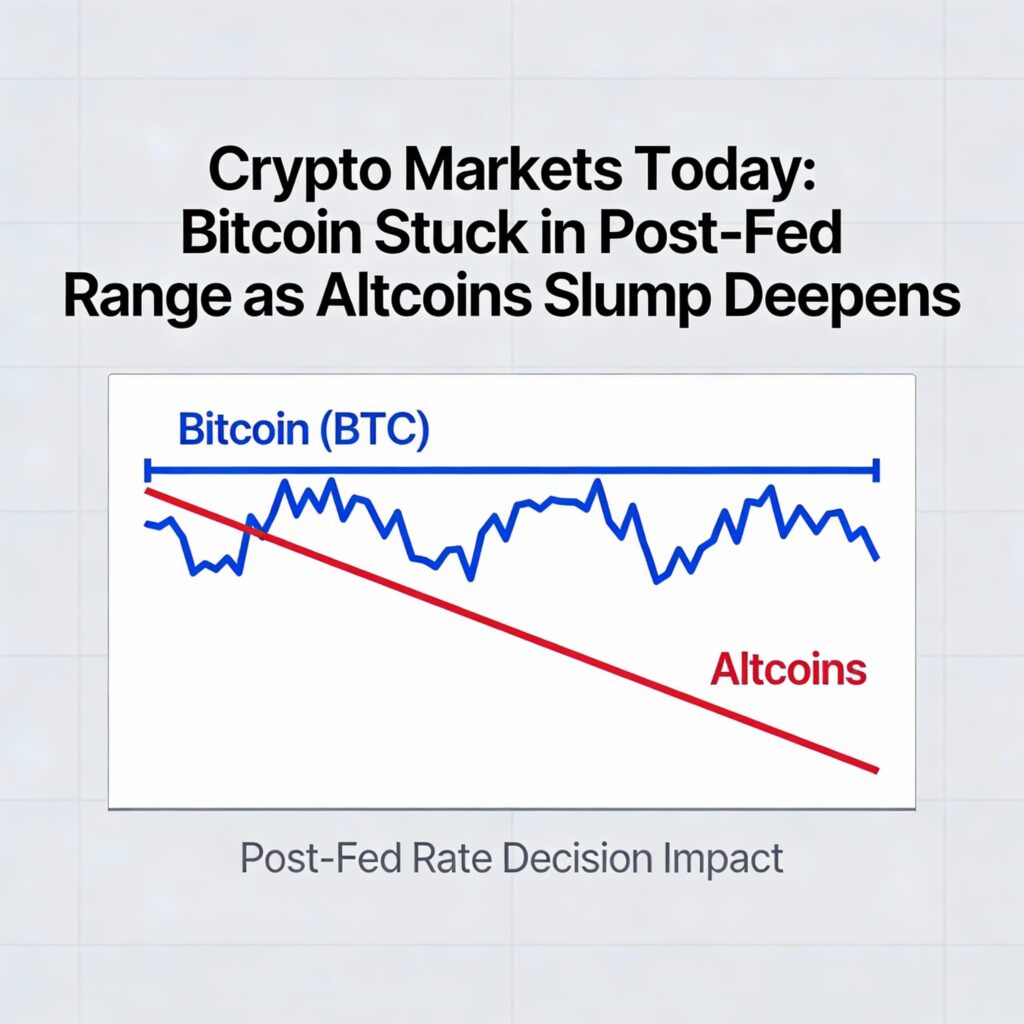

Bitcoin Stuck in Range Post-Fed as Altcoins and Memecoins Lag

Bitcoin remains range-bound despite the Federal Reserve’s recent 25-basis-point rate cut, while altcoins and memecoins struggle to gain traction amid shifting investor behavior.

BTC ($90,237.24) has spent the past week trapped between $88,000 and $94,000, with the market reacting unevenly to the Fed’s move. Typically, rate cuts boost risk assets as cash yields fall, but bitcoin briefly dipped below $90,000 before recovering to the upper end of its range. The CoinDesk 20 Index is up 0.57% since midnight UTC.

Altcoins remain weak. Tokens including JUP ($0.2021), KAS ($0.04612), and QNT ($79.72) have faced double-digit weekly losses, reflecting subdued risk appetite.

Derivatives & Market Flows

- BTC’s 30-day implied volatility (Volmex BVIV) has fallen to its lowest since Nov. 10, with ETH volatility similarly subdued.

- Deribit data shows put biases intact across BTC and ETH. Calendar spreads dominate block flows.

- Futures open interest is climbing for ZEC (+16% to 2.28M), HYPE, SUI, and SOL, while BTC and ETH OI remain steady.

Altcoin and Token Trends

Privacy coins lead gains, with ZEC up 9% in the past 24 hours. AAVE, HYPE, and LIDO saw intraday recoveries, though weekly performance remains muted. CoinMarketCap’s altcoin season indicator sits at a cycle low of 16/100. Memecoins lag heavily, with the CoinDesk Memecoin Index down 59% YTD versus a 7.3% decline for the CoinDesk 10.

The decline of memecoins highlights a shift from retail-driven speculation to institutional influence. ETFs and digital asset treasury strategies are reshaping market dynamics, favoring measured, steady gains over hype-driven trading.

More Stories

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin

Bitcoin stages violent reversal after 14-month low, sparking $740 million in liquidations

Cryptocurrencies stabilize as shutdown comes to a close