Strategy’s stock (MSTR) has tumbled sharply alongside Bitcoin, marking one of its largest declines since adopting a bitcoin treasury strategy in 2020.

One Year After the Peak

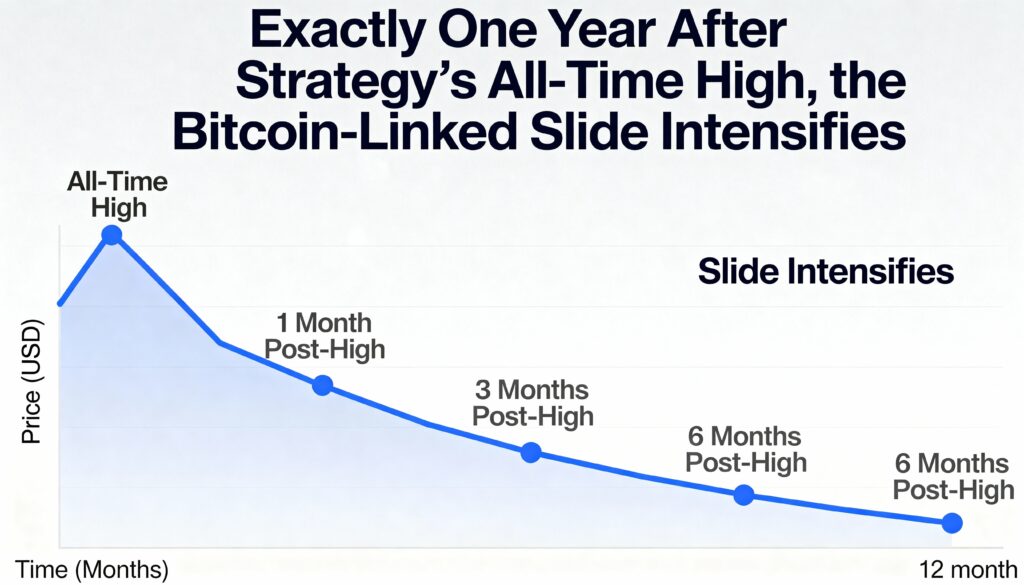

Exactly one year ago, Strategy reached an all-time high, riding a surge in Bitcoin, which was approaching $100,000. At the time, the company had established itself as a pioneer in holding bitcoin (BTC $87,033.52) as a corporate treasury asset.

Current Decline

Today, Strategy is trading 68% below its $543 peak, hit shortly after President Donald Trump’s election victory, while Bitcoin has slid to $83,142, its lowest since April. On Coinbase, BTC briefly fell as low as $81,385 on Friday. Strategy’s average purchase price of roughly $74,430 remains a key level for investors to monitor.

The drop from Bitcoin’s October record of $126,000 has pushed Strategy into an even steeper slide. The stock has broken below major moving averages and technical support levels, marking the joint second-worst drawdown since its bitcoin treasury program began in April 2020.

This decline echoes past sell-offs: a 69% drop between February and May 2021 occurred as Bitcoin fell from around $60,000 to $30,000, while the largest drawdown followed Bitcoin’s $69,000 peak in November 2021, resulting in an 84% sell-off that bottomed in June 2022. Since August 2020, Strategy has endured several drops exceeding 50%.

Market Implications

JPMorgan analysts caution that major equity benchmarks, such as MSCI USA and Nasdaq 100, could consider excluding Strategy. Such a move might trigger an estimated $2.8 billion in outflows from MSCI alone as index-tracking funds adjust their holdings. Passive investments, including ETFs, account for roughly $9 billion of the company’s market capitalization.

Valuation Insight

Even with the recent declines, Strategy trades at 1.23 times net asset value (mNAV), reflecting the enterprise value of its business relative to its bitcoin holdings. During the 2022 bear market, the stock often traded below mNAV, offering investors a discount to its underlying cryptocurrency assets.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin