Crypto markets posted modest gains Friday, shaking off another wave of tariff-related headlines after the Supreme Court of the United States ruled President Donald Trump’s global tariff rollout unlawful.

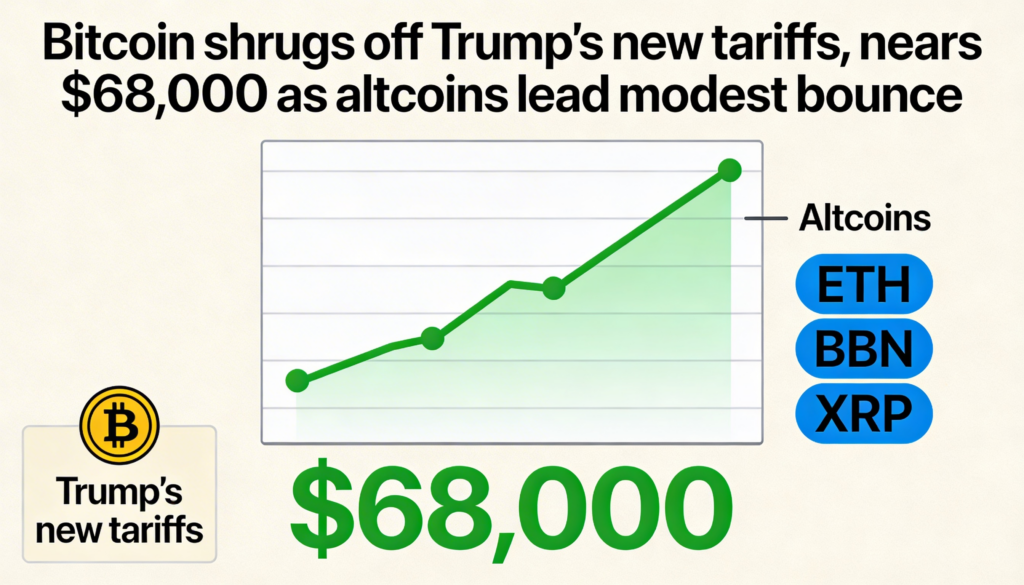

Bitcoin traded around $67,600 and approached the $68,000 level, while major altcoins outperformed with slightly stronger advances.

Tariff headlines fail to rattle markets

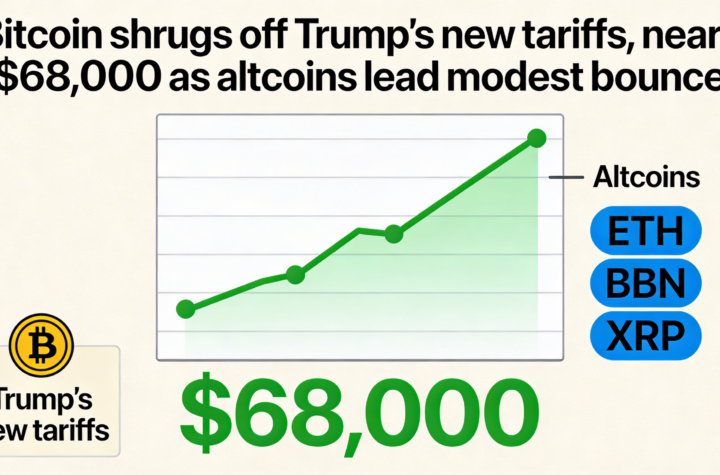

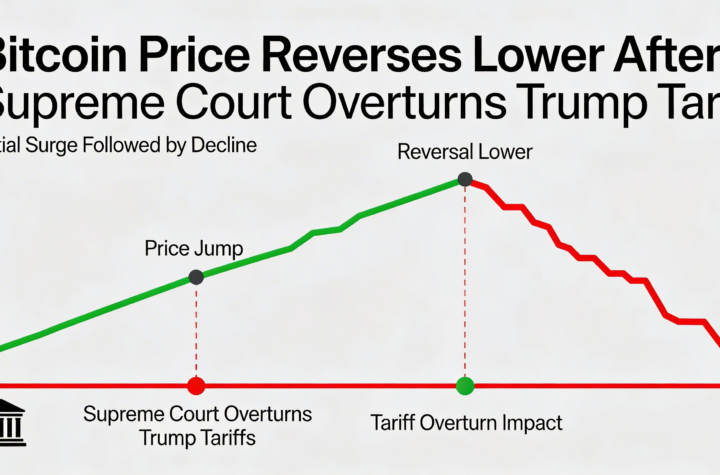

The day began with the Supreme Court’s 6–3 decision invalidating Trump’s sweeping tariff measures. The ruling did not specify how previously collected tariff revenue should be handled and left open the possibility that the administration could pursue alternative legal or executive routes to advance its trade agenda.

By the afternoon, Trump unveiled plans for an additional 10% global tariff under Section 122, set to take effect within three days and remain in place for approximately five months. Despite the fresh levy being layered on top of existing duties, market sentiment remained largely intact.

Risk assets edge higher

Digital assets moved modestly higher throughout the session. The CoinDesk 20 Index rose 2.5% over the past 24 hours, with BNB, Dogecoin, Cardano and Solana leading gains of 3% to 4%. Bitcoin remained just below the $68,000 threshold.

U.S. equities also advanced. The S&P 500 climbed 0.9%, while the Nasdaq-100 added 0.7%.

Among crypto-linked stocks, Coinbase, Circle and Strategy each gained more than 2%. In contrast, bitcoin miners tied to AI-focused infrastructure builds lagged, with Riot Platforms, Cipher Mining, IREN and TeraWulf declining between 3% and 6%.

Rangebound expectations persist

Paul Howard, director at trading firm Wincent, said the modest bounce reflects a broader narrative that tariffs may weigh on the macroeconomic outlook.

However, he noted that trading volumes remain subdued, limiting confidence in a sustained breakout. Without a meaningful macroeconomic or geopolitical catalyst, crypto assets are likely to continue moving within a narrow range.

A potential risk event on the horizon could involve escalating tensions with Iran, following weeks of military buildup in the region — a development that could quickly alter risk sentiment across global markets.

More Stories

Fears of a Blue Owl funding squeeze are stirring memories of 2008, with speculation that the turmoil may set the stage for bitcoin’s next rally.

Bitcoin rallies briefly, then slides as the Supreme Court strikes down Trump-era tariffs.

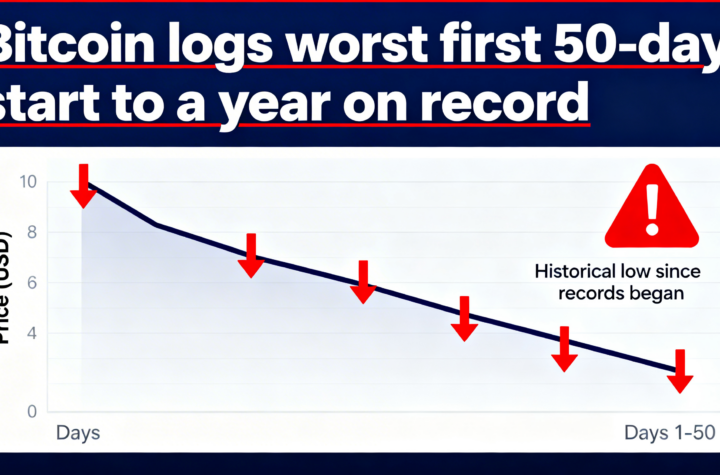

BTC records its worst start to a year through the first 50 days.