Bitcoin is on pace to post a fifth consecutive weekly loss, and a decisive break below current levels could pave the way for another move lower.

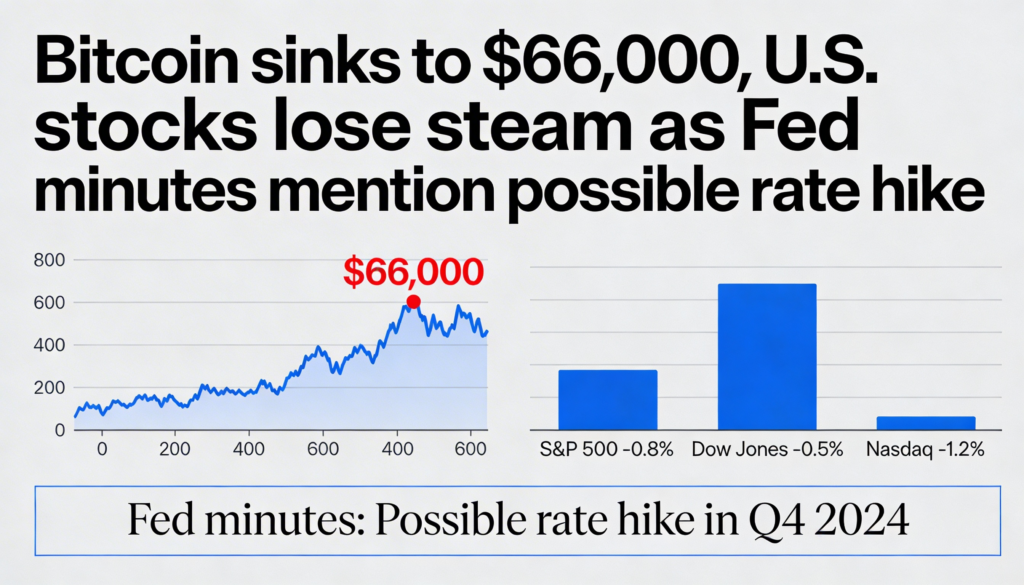

After trading sideways through much of Wednesday morning, BTC reversed course during U.S. afternoon hours, slipping beneath $66,000 and pressing against the lower boundary of its recent range. The token had earlier changed hands near $68,500 overnight but was down roughly 2.5% over the past 24 hours, last quoted around $66,200.

Crypto-linked equities, which opened with solid gains, also lost momentum as the session progressed. Coinbase swung from a 3% advance in early trading to a 2% decline by afternoon. MicroStrategy (MSTR), the largest corporate holder of bitcoin, fell about 3% in line with weakness in the underlying asset.

Broader markets showed a similar pattern. U.S. stocks surrendered much of their early strength ahead of the close, pressured in part by a hawkish tilt in the January minutes from the Federal Open Market Committee. While policymakers broadly supported holding rates steady, several participants floated the possibility of “two-sided” guidance, leaving the door open to renewed rate hikes should inflation remain stubborn.

The U.S. dollar extended gains following the release. The U.S. Dollar Index climbed to its highest level in nearly two weeks, adding headwinds for risk assets. A stronger greenback typically pressures cryptocurrencies, and Wednesday’s pullback in digital assets reflected that dynamic.

With the latest decline, bitcoin is now staring at its longest weekly losing streak since the 2022 bear market. The $66,000 zone has become a critical near-term support after holding last week and helping spark a rebound above $70,000. A sustained break below that level could shift focus toward the early-February lows near $60,000 — or potentially signal the start of a deeper correction.

More Stories

Bitcoin may rebound in the near term, but the market still lacks the momentum for a sustained rally.

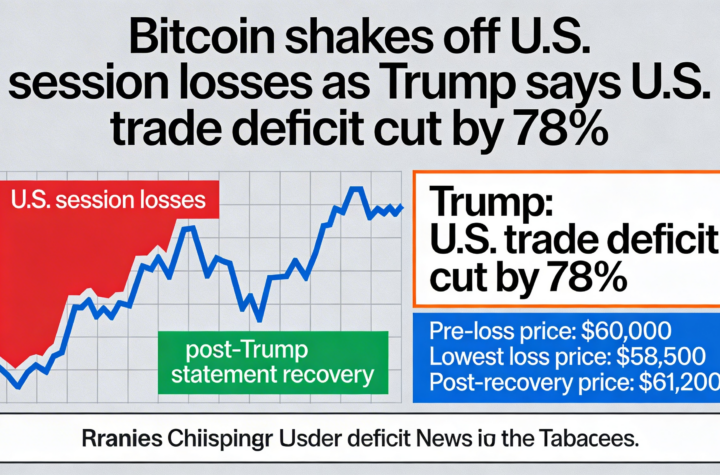

Bitcoin rebounds from U.S. session losses after Donald Trump claims the U.S. trade deficit has narrowed by 78%

Slipping under $70,000 could open the door to further downside for bitcoin.