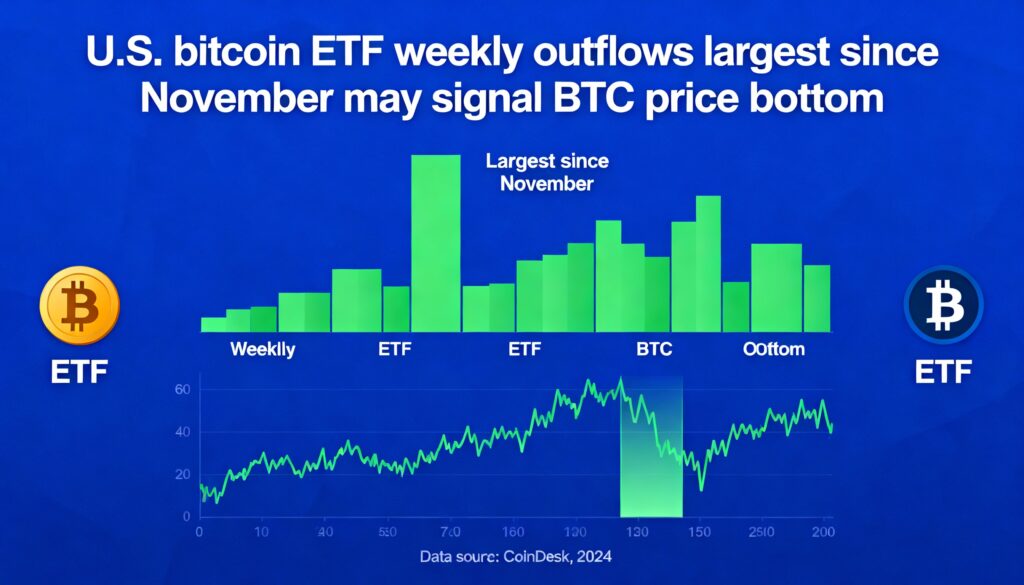

U.S. Bitcoin (BTC $88,748.27) ETFs saw their largest weekly outflows since November, a signal that often aligns with short-term price bottoms.

According to SoSoValue, a net $1.22 billion left ETFs over the four days ending Thursday, including $479.7 million on Tuesday and $708.7 million on Wednesday. Bitcoin declined roughly 5% during the same period and has remained relatively flat since the start of the year.

Historically, heavy ETF outflows have coincided with local lows. In November, a four-day withdrawal of $1.22 billion preceded a rebound from around $80,000 to over $90,000. Similar patterns were seen in March 2025, just before tariff-related market turbulence, when Bitcoin fell to $76,000, and in August 2024, when it bottomed near $49,000 during the unwinding of the yen carry trade.

Glassnode data shows the average ETF investor cost basis is currently $84,099, a level that has historically acted as support during pullbacks, including November 2025 and April 2025.

The combination of elevated outflows and historically significant support suggests Bitcoin may be nearing a potential short-term bottom.

More Stories

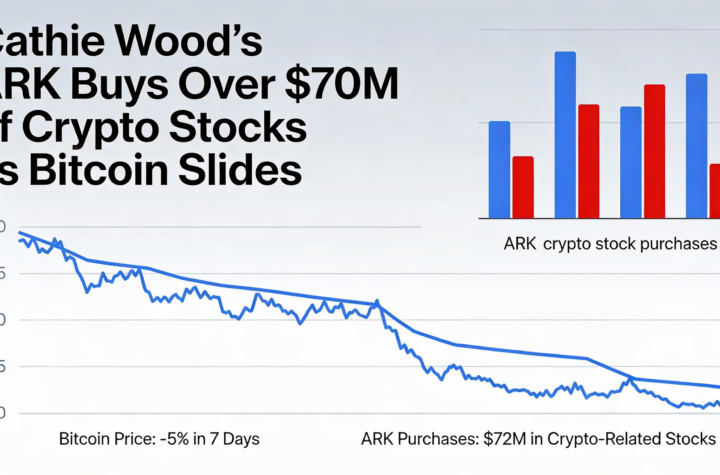

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO