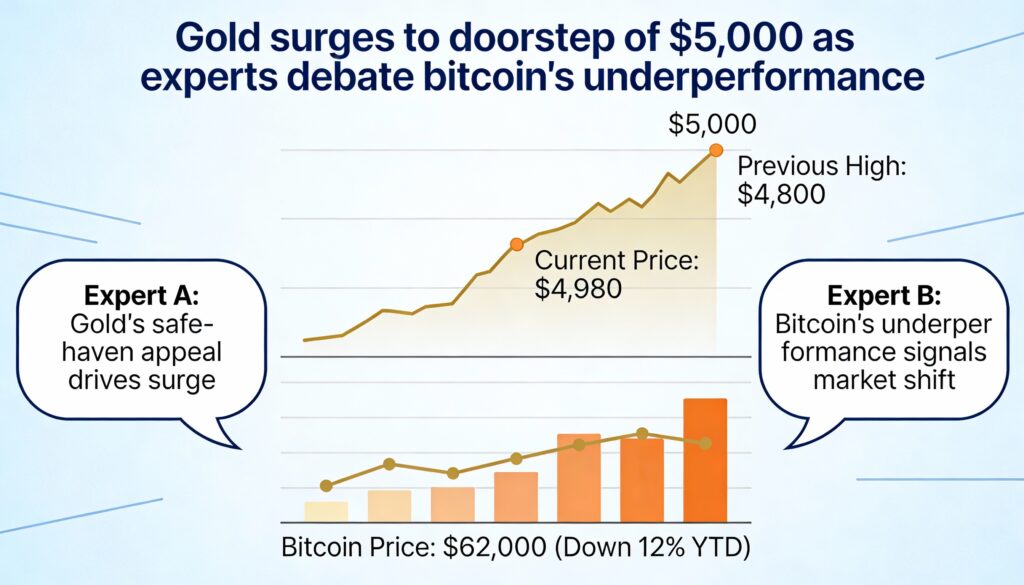

The rally in precious metals continues to gather pace, while bitcoin and the broader crypto market remain rangebound, reopening debate over whether BTC’s adoption-driven narrative has run out of steam.

Gold rose 1.7% on Thursday to trade near $4,930 per ounce, and silver jumped 3.7% to $96. Bitcoin, meanwhile, slid back toward $89,000, leaving it roughly 30% below its record high set in early October.

The divergence has prompted skepticism from some market observers. Bianco Research founder Jim Bianco questioned whether bitcoin’s adoption story still resonates with investors after months of subdued price action.

“[Bitcoin] adoption announcements are not working anymore,” Bianco wrote on X. “We need a new theme, and that’s not evident yet.”

Bloomberg ETF analyst Eric Balchunas pushed back on the criticism, arguing that bitcoin’s current consolidation should be viewed in the context of its prior surge. He noted that BTC rallied from below $16,000 during the depths of the 2022 crypto winter to a peak of $126,000 in October.

“It went up roughly 300% over the prior 20 months,” Balchunas said. “What do you want — 200% annual gains with no breaks?”

Balchunas added that bitcoin’s recent underperformance likely reflects profit-taking by early investors, which he described as a “silent IPO.” As one example, he cited a long-term holder who sold more than $9 billion worth of BTC in July after holding it for over a decade.

Bianco argued that bitcoin has lagged a broad range of assets over the 14 months since President Donald Trump’s election victory in November 2024. Over that period, he said, bitcoin is down 2.6%, while silver has gained 205%, gold 83%, the Nasdaq 24% and the S&P 500 17.6%.

“And while we wait for that new theme,” Bianco wrote, “everything else is racing ahead as BTC stays stuck in the mud.”

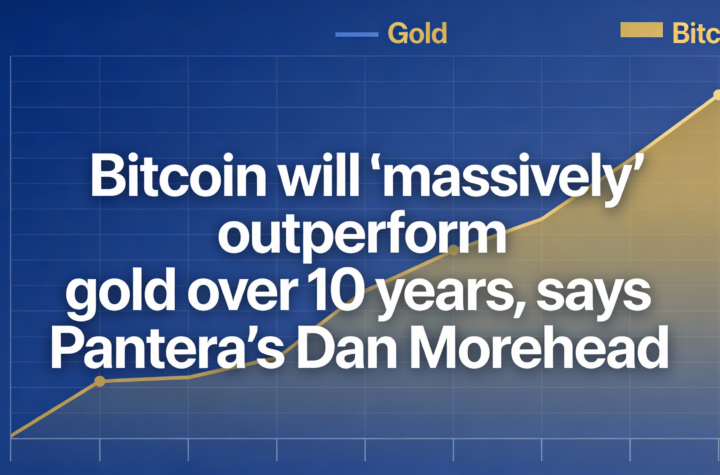

Balchunas closed by noting that as recently as November 2024, bitcoin was up 122% year-over-year and comfortably outperforming gold. The recent surge in precious metals, he said, reflects a period of catch-up rather than a decisive shift in long-term market leadership.

More Stories

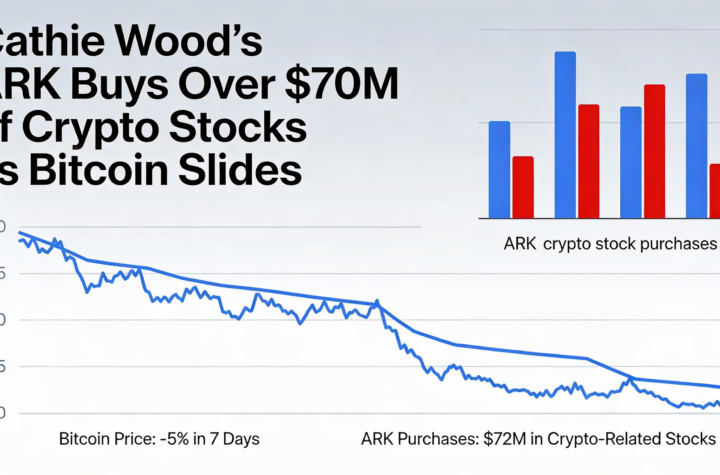

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO