Bitcoin has dropped 55% against gold since its December 2024 peak, underscoring its ongoing underperformance relative to the traditional safe-haven asset and challenging the narrative of bitcoin as “digital gold.”

Gold is pushing toward record highs just below $4,900 per ounce, up roughly 12% year-to-date, while bitcoin remains below $89,000 and has delivered only marginal gains for the year.

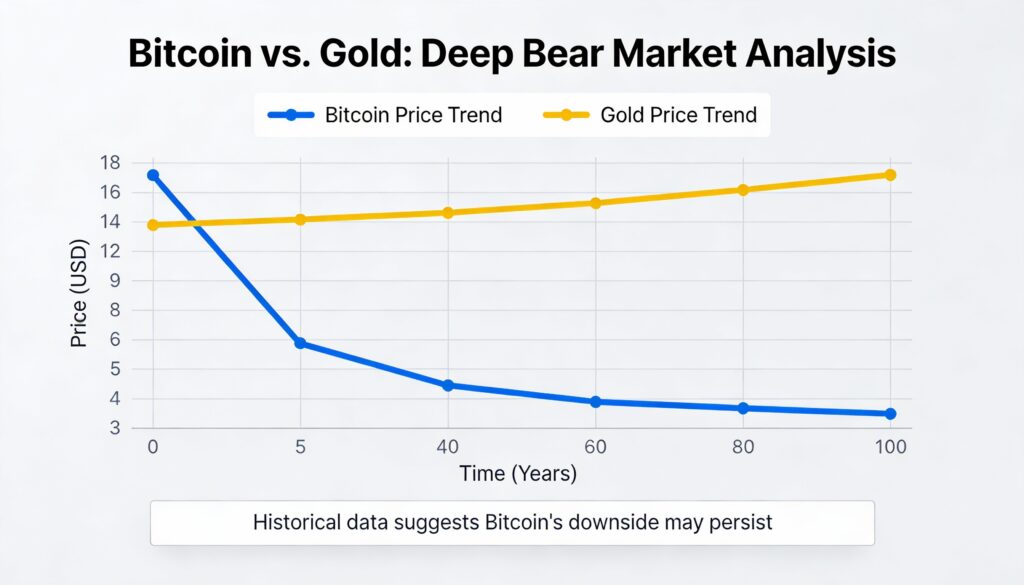

The divergence is also evident over longer time frames. Over one- and five-year periods, gold has outperformed bitcoin, rising roughly 160% over five years compared with bitcoin’s 150% gain.

The BTC-to-gold ratio currently sits near 18.46, well below its 200-week moving average (WMA), which tracks long-term trends over nearly four years of data. The 200WMA stands around 21.90, placing the ratio about 17% below this key trendline.

During the last major bear market in 2022, the ratio fell more than 30% below the 200WMA and remained there for over a year. The current breakdown began in November, suggesting that if history repeats, the ratio could remain below the 200WMA until late 2026.

The BTC-to-gold ratio peaked near 40.9 in December 2024, with bitcoin subsequently losing roughly 55% of its value relative to gold. Previous cycles saw even deeper declines, including a 77% drop in the 2022 bear market and an 84% fall during the 2017–2018 cycle.

More Stories

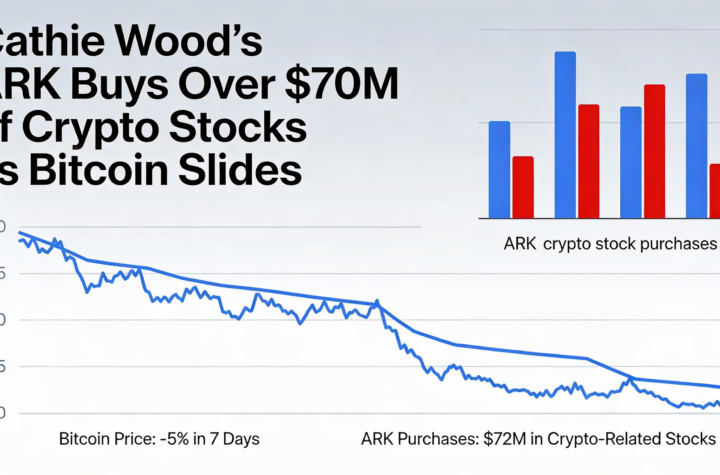

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO