Morgan Stanley Files for Bitcoin and Solana ETFs, Signaling Deeper Crypto Push

Morgan Stanley has filed with the SEC to launch a spot bitcoin (BTC $91,796) ETF and a Solana trust, underscoring the bank’s growing commitment to digital assets.

The Morgan Stanley Bitcoin Trust, outlined in a Jan. 6 Form S-1, is a passive ETF designed to track bitcoin’s price, net of fees and expenses. Shares will trade on a national exchange under a yet-to-be-announced ticker. The fund will hold bitcoin directly without leverage or derivatives, with net asset value calculated daily using a benchmark derived from major spot exchanges. Authorized participants can create or redeem shares in large blocks, while retail investors can buy and sell on the secondary market through brokerages.

Morgan Stanley’s move comes amid rapid growth in U.S. spot bitcoin ETFs, which now hold $123 billion in total net assets, roughly 6.57% of bitcoin’s market cap, according to SoSoValue. Net inflows into these products have topped $1.1 billion since the start of 2026. The Morgan Stanley Solana Trust will track SOL, joining a category with more than $1 billion in assets and nearly $800 million in cumulative inflows.

Strategic Expansion in Crypto

The filings mark a shift from distributing third-party crypto products to creating in-house ETFs, reflecting a stronger conviction in digital assets. Leveraging its wealth management network, Morgan Stanley can now integrate its own ETFs into client portfolios, retaining management fees in-house — a model proven lucrative by competitors such as BlackRock, whose spot bitcoin ETFs generated significant revenue in 2025.

More Stories

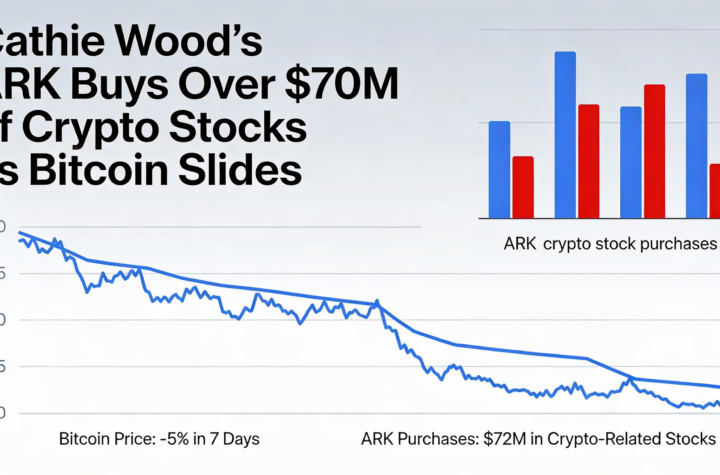

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO