Geopolitical developments in Venezuela and U.S. involvement plans are driving volatility in crypto markets.

Bitcoin surged past $91,000 on Sunday as traders extended the early-2026 rebound across major tokens. Ether, Solana, and Cardano posted broad gains, supported by heightened risk appetite amid fast-moving headlines from Venezuela.

Bitcoin traded near $91,300 during Asian morning hours, up roughly 1.4% on the day and more than 4% over the past week. Ether rose about 1% to $3,150, gaining around 7% for the week, while Solana climbed 1.6% and posted an 8% weekly gain. XRP hovered just above $2, up 0.6% on the day and nearly 10% for the week, and Cardano recorded modest daily gains while rising roughly 8% over seven days.

The rally followed a sharp liquidation flush that cleared crowded positions and reset near-term leverage. Roughly $180 million in futures positions were liquidated over 24 hours, with $133 million from shorts and $47 million from longs. The data suggest that traders betting against the rally were forced into buybacks as prices pushed higher.

Sunday’s gains were further supported by political developments in Venezuela. Former President Donald Trump said the U.S. plans to “run” Venezuela, though details remain scarce. Venezuela’s Supreme Court granted Vice President Delcy Rodríguez full presidential powers in an acting capacity after ousted President Nicolás Maduro was taken into U.S. custody.

Trump also highlighted U.S. interests in Venezuela’s oil sector, suggesting that ground troops would not be necessary if Rodríguez “does what we want.”

Crypto traders typically view such headlines as volatility triggers rather than direct macro drivers, but in periods of thin liquidity, even modest spot demand can push prices through technical levels and trigger stop-driven moves in futures markets. Concentrated short positions can amplify this effect, turning gradual rallies into sharper, accelerated gains.

More Stories

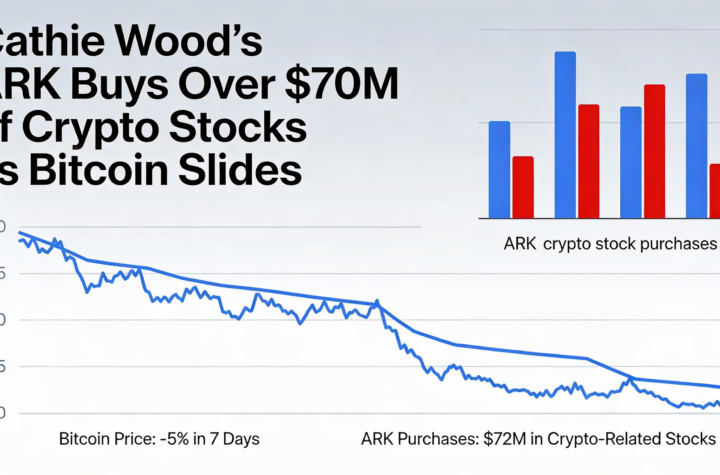

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO