Cantor Fitzgerald Predicts a Milder, Institutional-Led Crypto Winter in 2026

Cantor Fitzgerald sees early signs of a new crypto winter, though one expected to be less chaotic and increasingly driven by institutional activity, DeFi, tokenization, and clearer regulations.

Bitcoin (BTC $88,929.75) may face a prolonged downturn, consistent with its historical four-year cycle. Analyst Brett Knoblauch notes bitcoin is roughly 85 days past its peak, with prices potentially testing Strategy’s (MSTR) breakeven near $75,000. Unlike previous declines, mass liquidations are unlikely, as institutional players now shape market dynamics, highlighting divergences between token prices and underlying activity in DeFi, tokenized assets, and crypto infrastructure.

Real-world asset (RWA) tokenization is surging. Tokenized assets—including credit products, U.S. Treasuries, and equities—tripled in value in 2025 to $18.5 billion, with projections exceeding $50 billion in 2026 as institutions adopt on-chain settlement.

Decentralized exchanges (DEXs) are gaining share from centralized venues, particularly for perpetual futures, while the Digital Asset Market Clarity Act (CLARITY) provides regulatory certainty, reducing risks and enabling broader institutional participation.

On-chain prediction markets, especially in sports betting, have also grown rapidly, attracting players like Robinhood (HOOD), Coinbase (COIN), and Gemini (GEMI).

Risks remain: bitcoin trades only 17% above Strategy’s average cost basis, and digital asset trusts are slowing accumulation. Still, Cantor sees the crypto market laying the groundwork for stronger infrastructure and deeper institutional adoption despite cooling prices.

More Stories

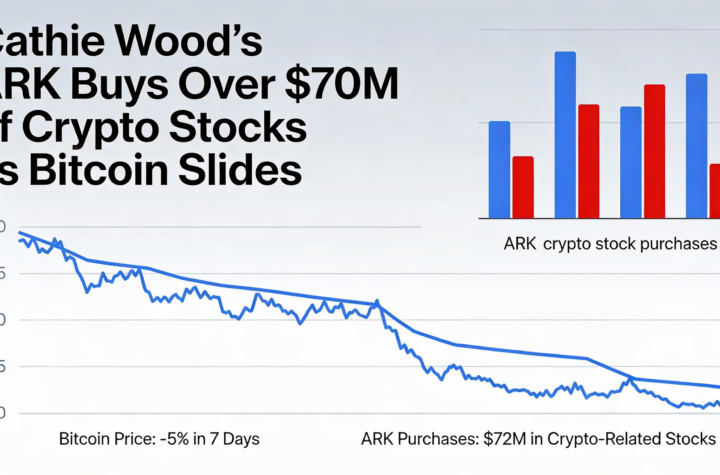

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO