Bitmine’s ETH Holdings Surpass 4.1 Million Tokens, Total Assets at $13.2 Billion

Tom Lee’s publicly traded mining and treasury firm, Bitmine Immersion Technologies (BMNR), now controls over 3% of Ethereum’s circulating supply and is ramping up staking operations.

In a Monday press release, Bitmine reported combined crypto, cash, and high-risk “moonshot” investments totaling $13.2 billion, driven largely by its ETH holdings of more than 4.1 million tokens. The company is now the world’s largest publicly owned ether treasury and ranks second among corporate crypto treasuries, behind bitcoin-focused Strategy (MSTR).

As of Dec. 28, Bitmine held 4,110,525 ETH, 192 BTC, a $23 million stake in Eightco Holdings, and $1 billion in cash. Its ether holdings account for roughly 3.41% of the network’s circulating supply of 120.7 million ETH, approaching its “alchemy of 5%” target.

“We remain the largest fresh-money buyer of ETH globally,” said Chairman Thomas Lee, noting year-end tax-loss selling typically weighs on crypto prices from Dec. 26–30.

Bitmine has staked 408,627 ETH, worth about $1.2 billion, and is working with three staking providers to launch its Made in America Validator Network (MAVAN) in early 2026. At the current Ethereum staking rate of 2.81%, full staking of its holdings could generate an estimated $374 million in annual revenue.

Ahead of its Jan. 15, 2026, shareholder meeting at the Wynn Las Vegas, Bitmine urged investors to support four proposals aligned with its long-term strategy.

Ether was trading near $2,950 over the past 24 hours at publication.

More Stories

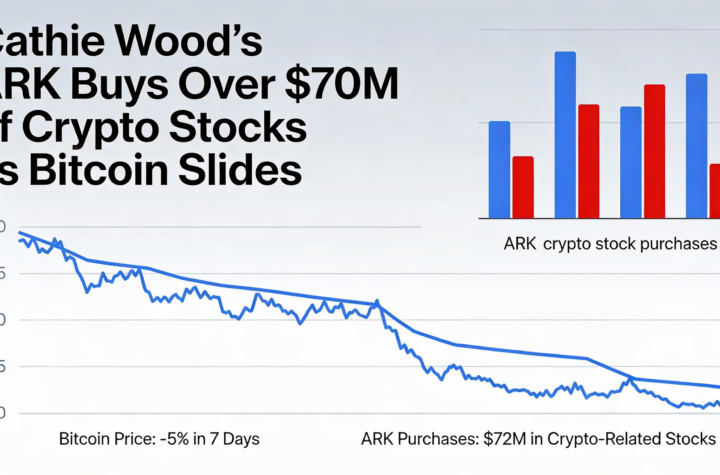

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO