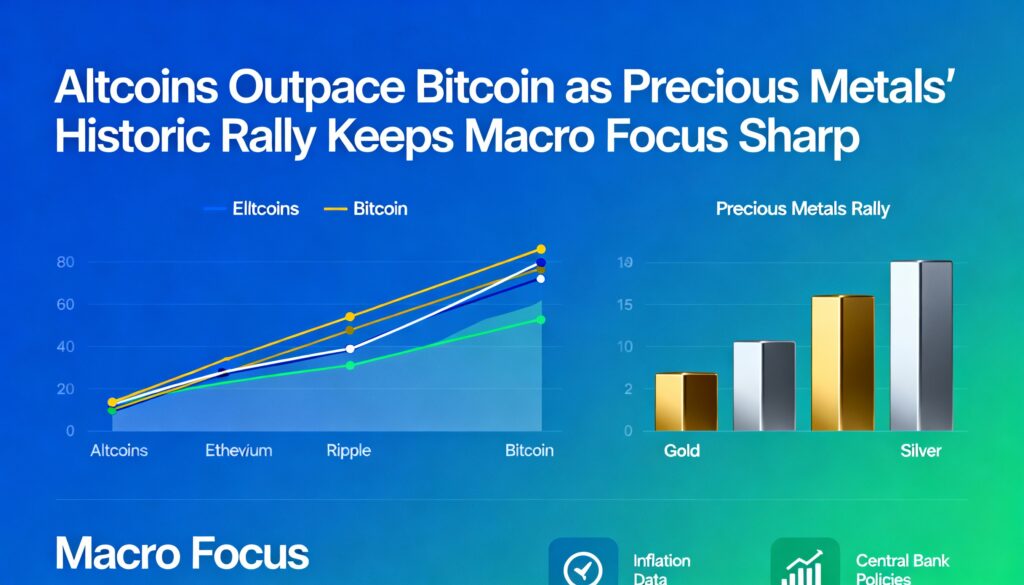

Altcoins Outperform Bitcoin as Precious Metals Rally Keeps Macro Focus Sharp

Altcoins outpaced bitcoin in relatively quiet Sunday trading, as BTC held a narrow range near $88,000 and investors continued watching a historic surge in precious metals.

As of 10:35 a.m. UTC, total crypto market capitalization stood at $3.06 trillion, up 0.8% over the past 24 hours. Bitcoin (BTC) rose 0.5% to $87,872, while ether (ETH) gained 0.5% to $2,939. Major altcoins posted stronger gains: XRP climbed 1.1%, Solana (SOL) advanced 1.3% to $123.28, and Dogecoin (DOGE) rose 1.3%, all outperforming BTC and ETH.

TradingView data from Bitstamp showed bitcoin confined to a tight band. After an early dip, BTC found support near $87,500 before rebounding toward $87,900. Each upward push met resistance, while pullbacks remained shallow—a pattern consistent with weekend consolidation in low-liquidity conditions.

Crypto analyst Michaël van de Poppe noted on X that BTC remains trapped between $86,500 and $90,000. He said a retest of the lower end could weaken support over time, with potential downside targets at $83,000 and $80,000. On the upside, a move above $90,000 and the 20-day moving average could open the door to a rally toward $105,000.

On-chain data

Glassnode highlighted that spot trading around $87,800 sits near the active investors’ mean at $87,700, while the short-term holder cost basis is $99,900, the true market mean is $81,100, and the realized price stands at $56,200. Analysts note that trading near the active investors’ mean often coincides with sideways price action, as small swings push holders between modest profit and loss.

Macro perspective

Precious metals continued to dominate investor attention. Silver has surged roughly 155% year-to-date, briefly becoming the world’s third-largest asset by market capitalization, while gold rose about 72% in 2025, echoing 1979’s high-inflation environment.

Fred Krueger, author of The Big Bitcoin Book, observed that silver lacks bitcoin’s network effects, suggesting it could fall quickly as narratives fade, while some investors may question why they did not simply hold bitcoin instead.

More Stories

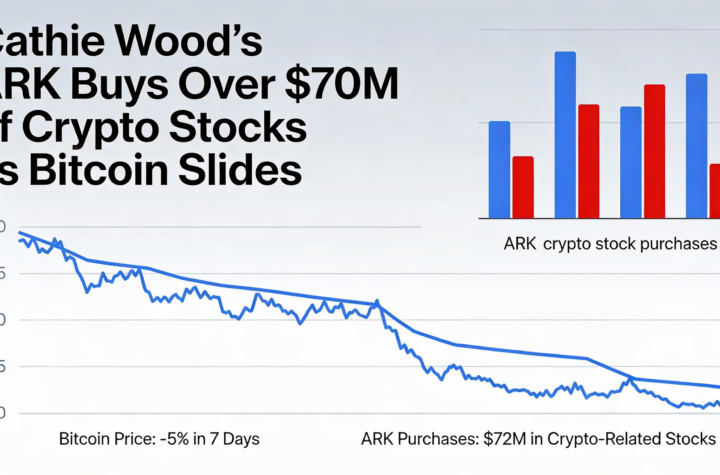

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO