Bitcoin (BTC $88,395.55) is trading near a crucial long-term support level that has held for the past three weeks, putting bulls on alert. At the same time, MicroStrategy (MSTR), the largest publicly listed holder of bitcoin, has already slipped below this key “safety net,” highlighting potential downside risks for the cryptocurrency.

The level in focus is the 100-week simple moving average (SMA), representing the average price over roughly two years. This moving average is a trusted metric among technical analysts for identifying major trend shifts and long-term support zones.

For bitcoin, the 100-week SMA has stabilized the decline from record highs above $126,000. Analysts often view it as a safety net: a bounce from this level could trigger a bullish rebound and bolster market confidence.

However, a break below the SMA could spark further selling, as holders exit positions and bearish sentiment gains traction. MicroStrategy’s recent performance provides a cautionary example: its shares fell below the 100-week SMA in November, foreshadowing potential weakness for BTC.

This mirrors an earlier pattern when MSTR led bitcoin lower after breaching the 50-week SMA, another key long-term benchmark. For BTC bulls, defending the 100-week SMA is critical. Holding above it may support a rebound, while a breakdown risks deeper losses following MSTR’s path.

More Stories

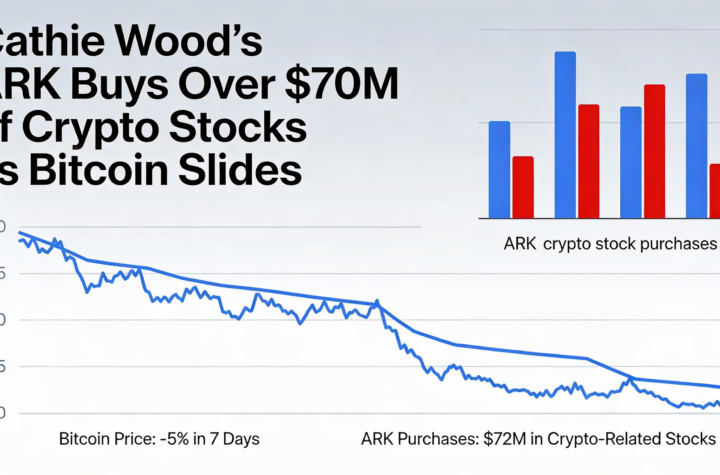

Cathie Wood’s ARK adds more than $70 million in crypto equities amid bitcoin pullback

Germans gain direct access to bitcoin, ether and solana through ING accounts

Musk’s SpaceX–xAI tie-up draws fresh scrutiny to bitcoin accounting before IPO