XRP Struggles at $2.00 Despite Institutional Tailwinds

XRP continues to face resistance at the $2.00 level, with elevated trading volumes suggesting sellers are defending the zone even as institutional support strengthens.

Market Context

Despite broader crypto gains following the Federal Reserve’s 25-basis-point rate cut to 3.5%–3.75%, XRP has struggled to follow through. Internal Fed concerns over inflation have limited speculative upside, keeping price action subdued.

Institutional developments remain supportive. U.S. spot XRP ETFs have seen steady inflows, while ecosystem expansions—including custody, DeFi, and cross-chain integrations—highlight long-term adoption trends. Yet these positive fundamentals have not translated into decisive technical gains.

Technical Overview

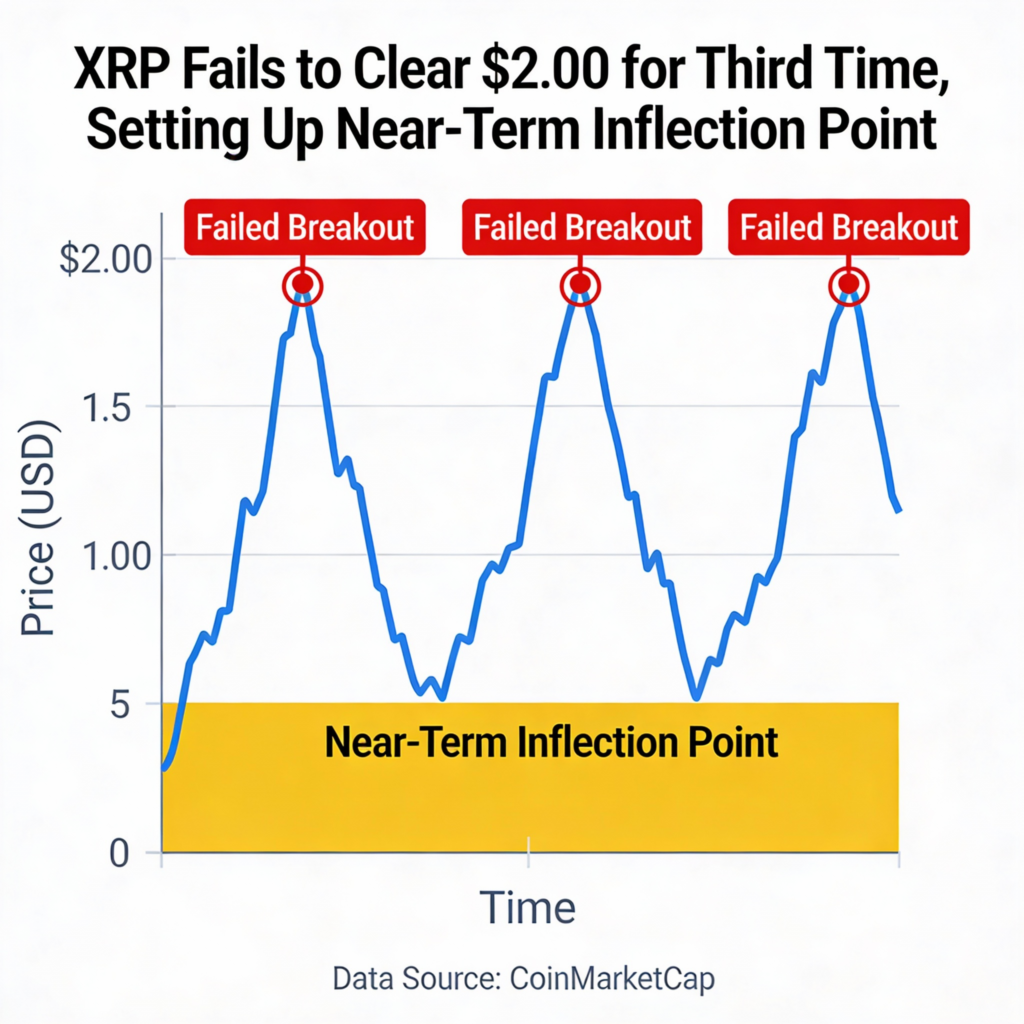

XRP is capped below $2.00–$2.01, a resistance zone that has now rejected price three times. Each rejection coincided with rising volume—most recently 186% above average—indicating active selling rather than passive consolidation. Momentum remains mixed: RSI is stable but not bullish, and intraday structure shows lower highs below $2.03.

Price action is compressing between support at $1.97–$1.98 and supply at $2.00–$2.01, keeping XRP range-bound. Late-session rebounds briefly pierced $2.00 but lacked follow-through.

Key Takeaways for Traders

- Sellers remain in control until XRP clears $2.01.

- A sustained breakout above $2.01 could target $2.15–$2.20.

- Support at $1.97 must hold to avoid downside toward $1.90–$1.92.

- ETF inflows and ecosystem growth provide underlying support.

- Range-bound trading is likely until a clear breakout or breakdown occurs.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin