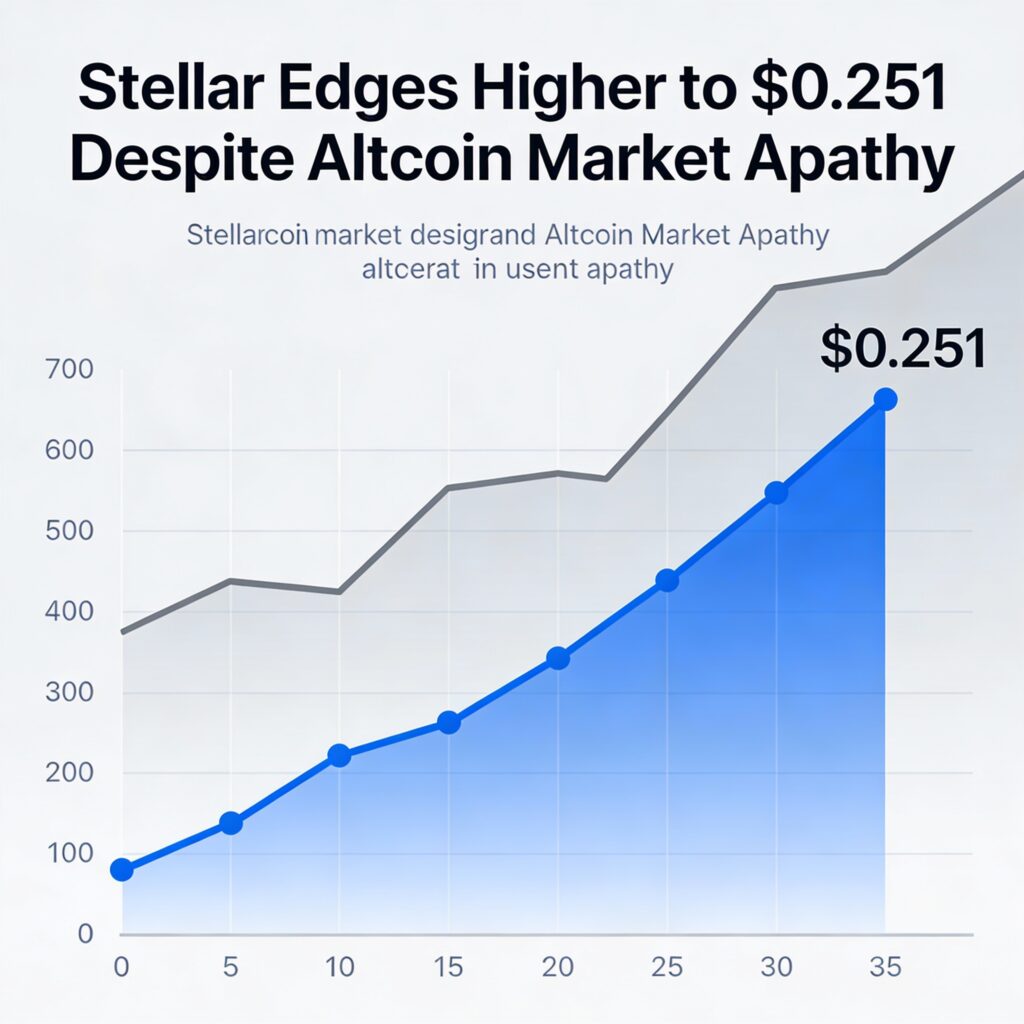

Stellar (XLM) saw a notable pickup in trading activity on Wednesday, with volume climbing 19% above its weekly average as the token continued to stabilize around the key $0.25 support area. XLM inched up 0.85% over the past day to $0.251, a muted move that stood out amid broader altcoin lethargy.

Despite the slight advance, XLM underperformed the overall digital asset index by 0.45%, pointing to token-specific flows rather than sector momentum. Elevated volume alongside limited price strength suggests accumulation is taking place, even as buyers and sellers remain locked in a tight range.

Intraday action unfolded in two stages: XLM held steady near $0.251 through most of the afternoon before sliding to $0.2492. The token then retraced gradually back to $0.2502. With no major catalysts in play, the $0.25 level emerged as the focal point for institutional positioning, shaping short-term price discovery.

This kind of high-volume, low-momentum standoff often precedes either a breakout from consolidation or a slow accumulation phase. Market direction will ultimately depend on whether institutional demand can absorb the remaining sell pressure at current levels.

Key Technical Signals for XLM

- Support & Resistance: The $0.2500 support zone continues to hold after repeated tests, while resistance has formed at $0.2578 following an early-session rejection.

- Volume Dynamics: Institutional flows peaked at $0.2578, with volume surging 245% above 24-hour averages before tapering into the close.

- Chart Structure: XLM remains locked in a volatile sideways channel spanning $0.0081 (3.2%), with a pattern of lower highs reinforcing consolidation.

- Risk/Reward Outlook: A drop below $0.2500 would likely invite further selling, while sustained strength above this level keeps the door open for a bullish breakout attempt.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin