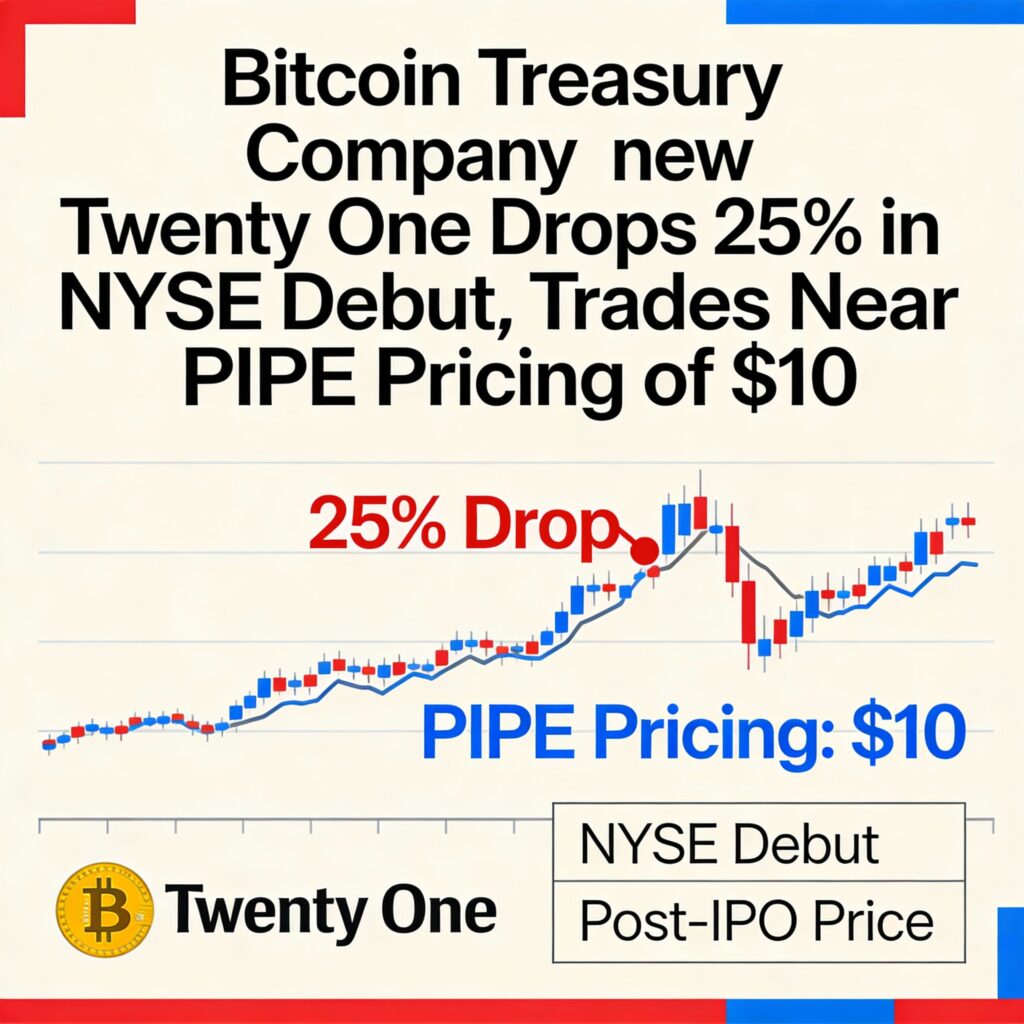

Twenty One (XXI) opened its first day of trading with a 25% decline following the completion of its SPAC merger with Cantor Equity Partners (CEP). Shares are now changing hands near $10.50, putting the bitcoin-focused company close to its PIPE price of $10.

The firm enters the market with the third-largest corporate bitcoin treasury, holding 43,514 BTC. Backed by Tether, Bitfinex, and Strike CEO Jack Mallers — who also serves as XXI’s CEO — the company emphasizes capital-efficient bitcoin accumulation and bitcoin ecosystem services underpinned by on-chain proof of reserves.

XXI’s early pullback continues a trend among 2025’s bitcoin treasury SPACs. Anthony Pompliano’s ProCap BTC (BRR) has dropped over 60% since its debut last week, now trading near $3.75, as PIPE valuations face pressure.

The high-profile U.S.-listed bitcoin treasury KindlyMD (NAKA) has fared even worse, down 99% from its all-time high to $0.43.

Bitcoin itself was little changed over the past 24 hours, hovering around $90,900.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin