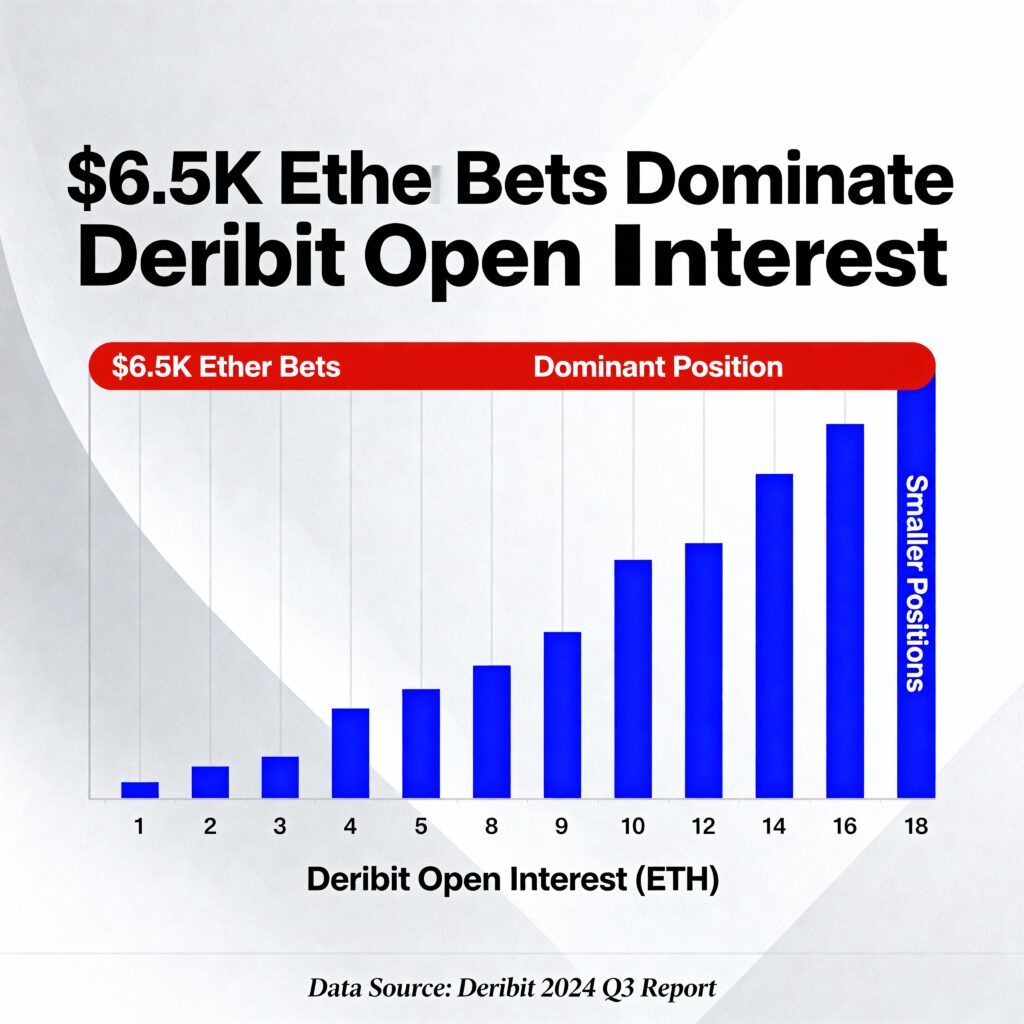

The $6,500 Ether call option on Deribit has emerged as the most popular strike, with notional open interest exceeding $380 million.

Even amid a challenging quarter for Ether, traders continue to favor the $6,500 call. Current data from Deribit Metrics show that notional open interest—the total dollar value of active contracts—stands at $383.5 million, topping all other Ether options on the platform. Other notable strikes drawing attention include $4,000, $5,500, and $6,000 calls.

Buying a $6,500 call signals a bet that Ether’s spot price will rise above that level, reflecting a bullish outlook among investors.

Ether has seen a rough quarter, with its price down approximately 26% to $3,033. CoinDesk data indicate that prices even dipped below $2,650 at one point last month.

More Stories

Altcoins gain alongside ether as bitcoin recovers $76,000, but upside looks fragile

U.S. drives institutional crypto while Asia tops trading activity, CoinDesk Research finds

Michael Burry sounds ‘death spiral’ alarm after silver liquidations surpass bitcoin