Strategy’s Bitcoin Holdings Reach Nearly $65 Billion, Ranking as 11th Largest U.S. Corporate Treasury

Strategy (MSTR) has accumulated close to $65 billion in bitcoin, making its treasury one of the largest among U.S. corporations and comparable to the cash reserves held by some of the nation’s biggest companies.

In its latest investor presentation for the STRD at-the-market equity program, Strategy compared its bitcoin assets to traditional corporate cash balances. Leading the list is Berkshire Hathaway, which holds $410 billion in cash and equivalents, followed by tech giant NVIDIA (NVDA) with $66 billion.

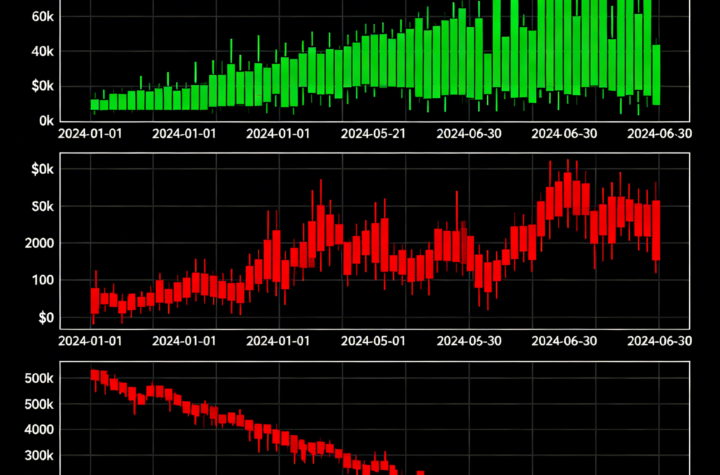

The company remains on track to achieve its 2025 targets, reporting a bitcoin yield of 19.7%, approaching its 25% goal, and bitcoin gains of $9.6 billion against a $15 billion target. During the second quarter alone, Strategy posted an unrealized gain of $14 billion on its bitcoin holdings.

Strategy’s perpetual preferred shares have outperformed the iShares Preferred and Income Securities ETF (PFF), which serves as a benchmark. Since launch, STRK shares have gained 51%, compared to a 3% decline in PFF. STRF has risen 38% versus a 1% drop in PFF, while STRD increased 12% against a 2% gain in PFF.

As part of its $42 billion capital raise program, Strategy has secured $23.9 billion to date and retains $34.1 billion of fixed-income capacity under the offering.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%