Strategy Books $14B Bitcoin Profit in Q2, Unveils $4.2B STRD Preferred Stock Offering

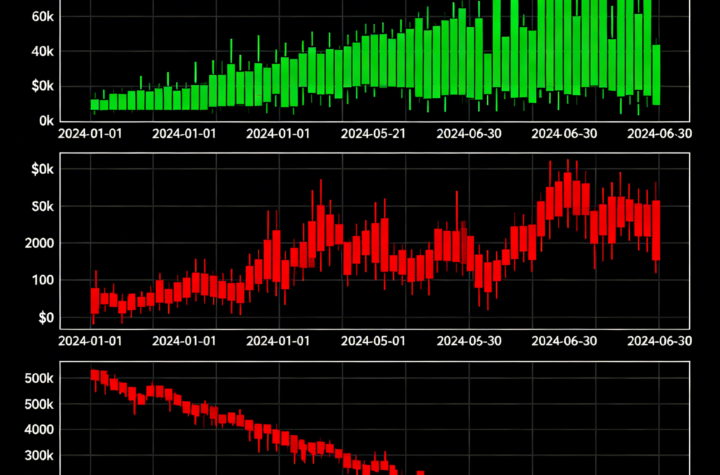

Bitcoin’s price climbed roughly 30% in the second quarter, rising from around $82,000 to $108,000 by June 30.

As a result, Michael Saylor-led Strategy (MSTR) anticipates reporting a $14.05 billion gain for the quarter on its bitcoin holdings, which total more than 500,000 BTC.

In a filing released Monday morning, Strategy disclosed it had raised $6.8 billion in net proceeds during Q2 through various capital markets activities, including preferred stock offerings and at-the-market (ATM) sales of its Class A common stock. As of June 30, the company maintained substantial capacity for further fundraising, with $18.1 billion remaining under its 2025 Common ATM, $20.5 billion under the STRK ATM, and $1.9 billion under the STRF ATM.

Later on Monday, Strategy announced a new sales agreement allowing it to issue and sell up to $4.2 billion of its 10% Series A Perpetual Stride Preferred Stock (STRD) through an ATM offering program.

The company plans to gradually sell STRD shares based on prevailing market prices and trading volumes. Proceeds from the ATM program are earmarked for general corporate purposes, including additional bitcoin acquisitions, supporting working capital, and potentially funding dividends for holders of both its 10% Series A Perpetual Stride Preferred Stock and its 8.00% Series A Perpetual Strike Preferred Stock.

Since debuting on June 11, STRD shares have risen 6%. Meanwhile, MSTR shares were down 1.2% in premarket trading Monday, as bitcoin traded slightly lower from late last week at around $108,300.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%