DOGE Rallies to $0.23 on Whale Activity, but Resistance Caps Momentum

Dogecoin (DOGE) posted a 4% gain on Friday, climbing from $0.22 to $0.23 amid a surge in whale-led accumulation and leveraged long positioning. However, the rally met heavy resistance at $0.23, where profit-taking and potential large-holder distribution checked further upside.

Whale Accumulation Drives Early Gains

Over $200 million in DOGE was accumulated by large wallets over a 24-hour window, with most of the buying concentrated at the $0.22 level — a zone that held firm across multiple retests. Strong bid-side volume supported a sustained advance, pulling in leveraged longs ahead of the breakout attempt.

Profit-Taking Emerges at Supply Zone

Despite bullish flows, DOGE’s move stalled at the $0.23 mark — a level that triggered aggressive selling by short-term traders and may have prompted distribution from institutional-sized holders. The supply zone above this level remains a key ceiling for price.

Technical Performance Summary

- Price Range (24H): DOGE traded between $0.22–$0.23, reflecting 5% volatility.

- Volume at Support: $0.22 was defended on strong 262.2M bid-side volume at 05:00 UTC.

- Volume at Resistance: $0.23 attracted 780.9M in sell-side volume at 14:00 UTC — the session peak.

- Whale Buys: Over 1 billion DOGE accumulated in 24 hours.

- Ownership Shift: Whale ownership now represents nearly 50% of circulating supply.

Late-Session Breakdown and Consolidation

DOGE pulled back 1% in the final hour of trade, slipping from $0.23 to $0.227. The breakdown occurred at 03:34 UTC on 11.4M volume, followed by a 24.1M spike. Price then consolidated between $0.227–$0.229, indicating a cooling period amid elevated volume.

Key Technical Takeaways

- Support: $0.22 confirmed as a strong floor backed by sustained volume.

- Resistance: $0.23 capped gains, with notable selling pressure and distribution.

- Volume Signals: Final-hour action saw 8x the average hourly volume, likely driven by institutional exits or rotation strategies.

- Market Structure: While near-term upside faces headwinds, the structural support at $0.22 suggests buyers remain active below.

More Stories

Bitcoin tests $70,000 but retreats, with altcoins powering the strongest bounce seen in weeks.

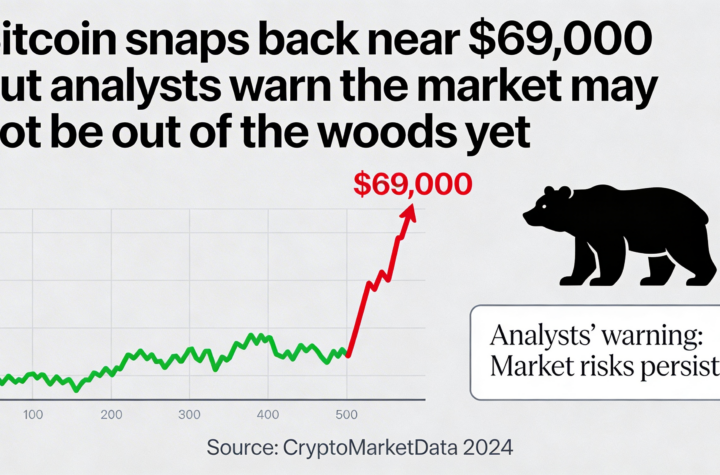

Bitcoin rallies close to $69,000 as analysts warn turbulence may not be over.

With only $75 in leased mining power, a solo Bitcoin miner secures a $200,000 block reward.