THORChain Launches TCY Token to Convert $200M Debt into Equity

THORChain has introduced a new strategy to address its $200 million debt by converting it into equity through a new token, TCY (Thorchain Yield). Following the approval of “Proposal6,” the project will issue a total of 200 million TCY tokens, distributing them at a 1:1 ratio per dollar of defaulted debt, thereby turning impacted lenders and savers into equity stakeholders.

This decision comes after THORChain paused its THORFi services on January 23 due to financial uncertainty, as reported by CoinDesk.

In addition, THORChain will create a liquidity pool for RUNE and TCY, initially funded with $500,000 at a rate of $0.1 per TCY, using $5 million from its treasury.

Holders of TCY tokens will receive 10% of the platform’s revenue indefinitely, offering a potential long-term incentive for those impacted by the debt crisis. However, the exact timeline for full recovery remains uncertain.

While facing financial challenges, THORChain’s cross-chain swap services remain unaffected. In the past 24 hours, RUNE’s price has dropped by 10%, extending its 30-day losses to nearly 50%, in line with the broader market trend.

More Stories

Silver plunges 35% and gold slides 12% amid a metals selloff, with bitcoin holding firm at $83,000.

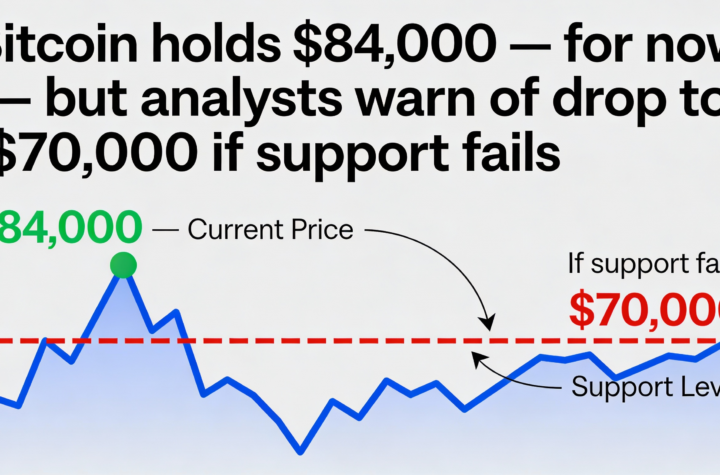

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

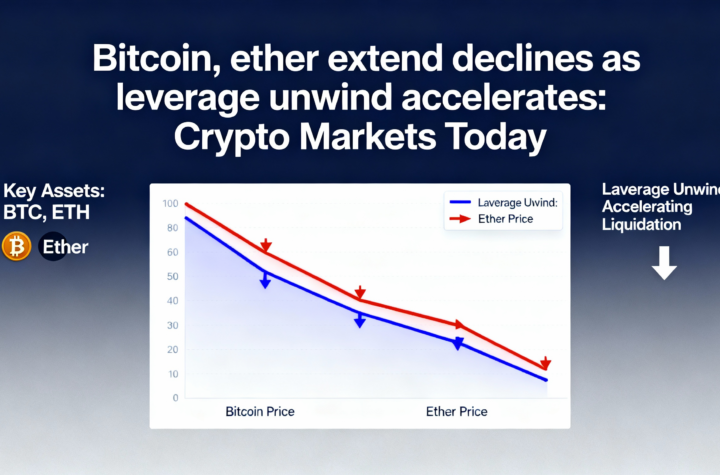

Crypto selloff intensifies as bitcoin and ether extend losses amid leverage unwind