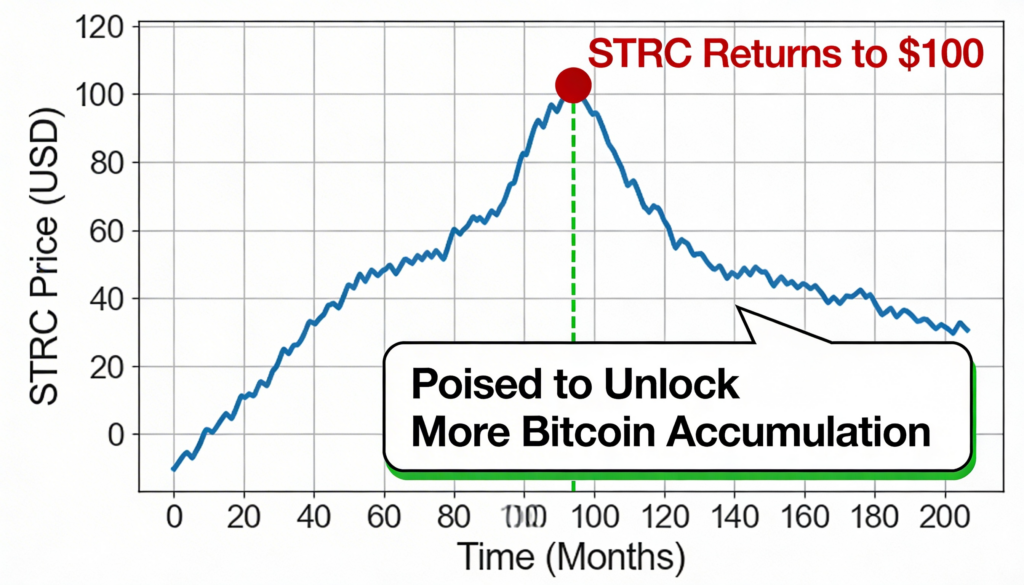

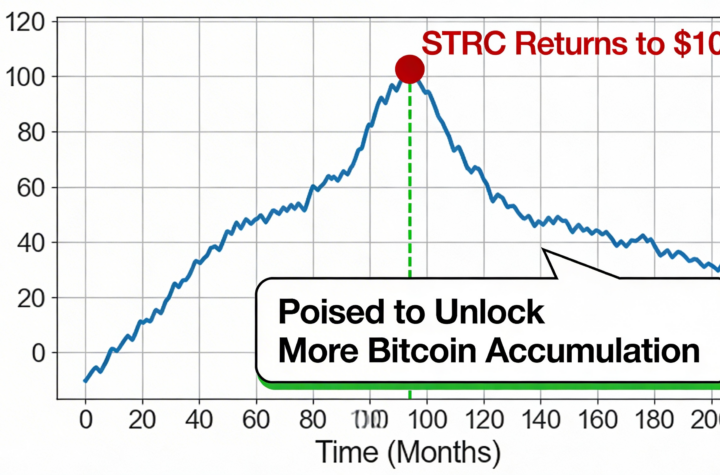

The perpetual preferred security STRC, issued by Strategy (MSTR), regained its $100 par value during Wednesday’s U.S. trading session, reaching that threshold for the first time since mid-January despite ongoing weakness in bitcoin.

Trading at or above par is a key milestone for STRC, as it enables Strategy to resume at-the-market (ATM) sales of the preferred shares to finance additional bitcoin acquisitions. The security previously touched $100 on Jan. 16, when bitcoin was trading near $97,000. As the cryptocurrency later dropped to around $60,000 on Feb. 5, STRC slid to a low of $93 before recovering in recent sessions.

Designed as a short-duration, income-focused instrument, STRC currently offers an 11.25% annual dividend paid monthly. The company adjusts the payout rate each month in an effort to keep the shares trading close to par, recently lifting the yield to 11.25% to support price stability.

At the same time, Strategy’s common stock faced renewed pressure. MSTR shares fell 5% on Wednesday to close at $126, while bitcoin changed hands near $67,500.

More Stories

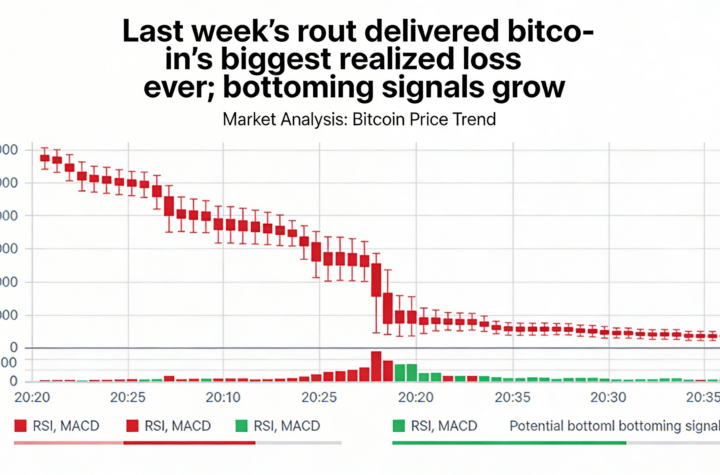

Bitcoin logged its biggest realized loss ever during last week’s rout, with bottoming signals now building.

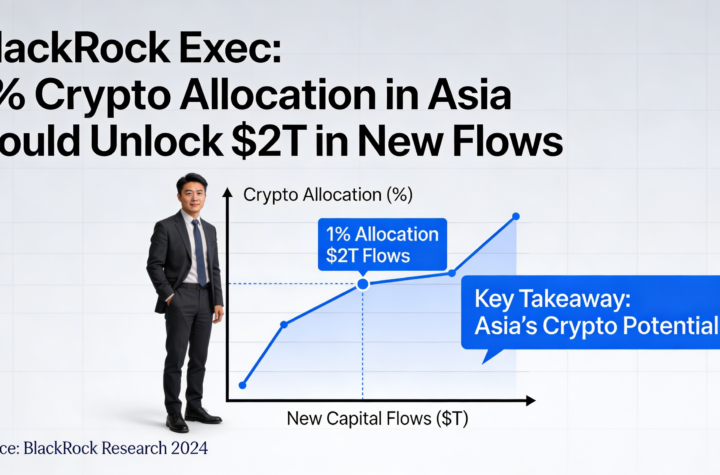

A 1% shift into crypto by Asian investors could generate $2 trillion in new capital, says a BlackRock exec.

Robinhood falls short of Q4 revenue expectations as crypto downturn weighs on quarterly results.