Bitcoin’s Tepid Rebound Leaves Bears in Control Below $114K

Bitcoin

BTC

$113,141.16

Bitcoin’s recent attempt to stabilize around $113,000 is losing steam, with lackluster price action and muted trading volume offering little support to the bulls. Despite a slight uptick, the bounce has stalled beneath $114,000, and volumes remain notably lower than those seen during Tuesday’s sharp decline, according to hourly chart data.

Technicals paint a bearish picture. The 50-, 100-, and 200-hour simple moving averages are lined up in a downward trend—an alignment that reinforces downside momentum.

On the daily chart, bitcoin has broken decisively below a key rising trendline, marking a transition from bullish to bearish structure. The MACD indicators—both long-term (50,100,9) and standard (12,26,0)—are showing deepening negative bars below the zero line, confirming accelerating bearish pressure.

With the current trend, further downside appears likely. Immediate support stands at $111,982, the level that marked a previous reversal on August 3. Below that, the 100-day SMA at $110,053 and 200-day SMA at $100,484 are the next levels to watch.

A move back above the 50-day SMA at $116,033 would be needed to challenge the bearish setup and revive near-term bullish sentiment.

Support levels: $111,982, $110,053, $100,484

Resistance levels: $116,033, $120,000, $122,056

More Stories

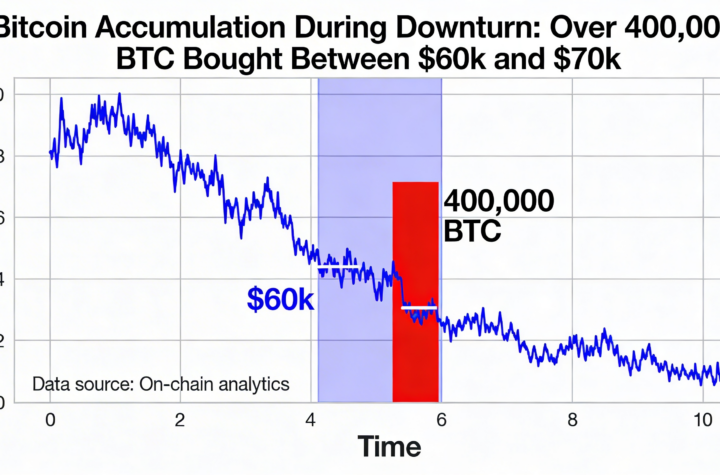

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

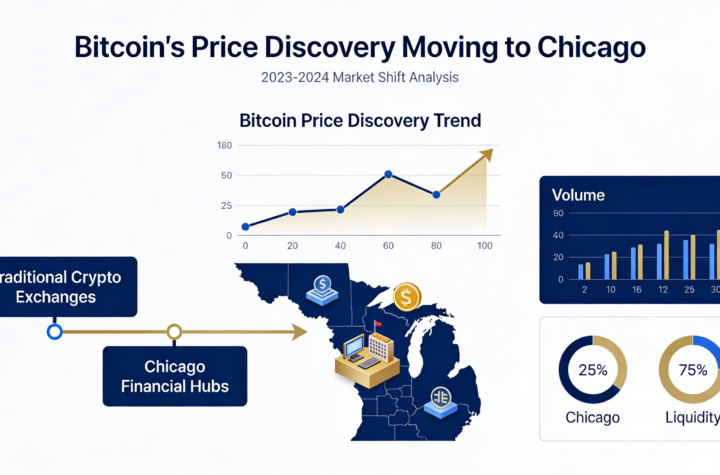

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago