The European Union’s Markets in Crypto-Assets (MiCA) framework, which became effective on December 30, is expected to drive significant growth in euro-backed stablecoins, according to a Wednesday report by JPMorgan (JPM).

“MiCA regulations permit only compliant stablecoins to be utilized as trading pairs on regulated EU exchanges, prompting a shift in market dynamics,” wrote JPMorgan analysts led by Nikolaos Panigirtzoglou.

This shift has benefited regulated euro-denominated tokens such as Circle’s EURC while pressuring non-compliant alternatives like Tether’s EURT, the report highlighted.

Stablecoins, which are designed to maintain a stable value, are typically pegged to assets such as fiat currencies or commodities, with the euro and U.S. dollar being the most common.

MiCA’s stringent requirements now compel issuers to hold substantial reserves within EU banks and obtain appropriate licenses. These regulations led to Tether announcing the wind-down of its EURT stablecoin in November, allowing holders a 12-month redemption window.

Additionally, several EU-based exchanges have delisted Tether’s USDT, reducing its presence in the bloc. However, Tether continues to dominate the global stablecoin market, thriving particularly in regions like Asia, where regulations are less restrictive.

To stay relevant in the EU, Tether has invested in compliant ventures such as Quantoz Payments and StablR, showcasing its commitment to adapting to MiCA’s evolving regulatory environment and maintaining a foothold in the European market.

More Stories

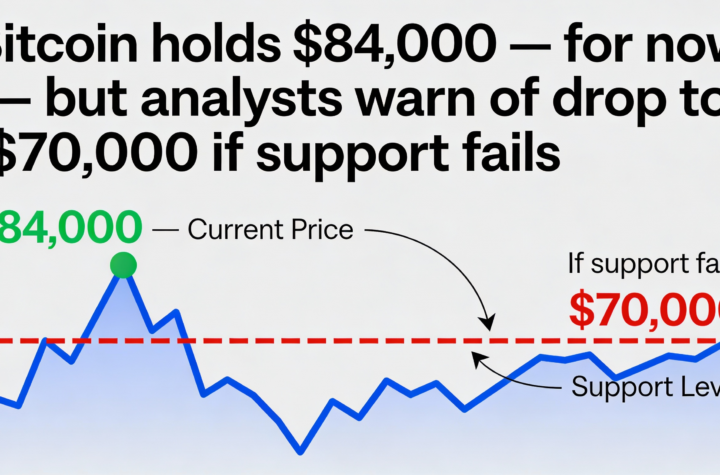

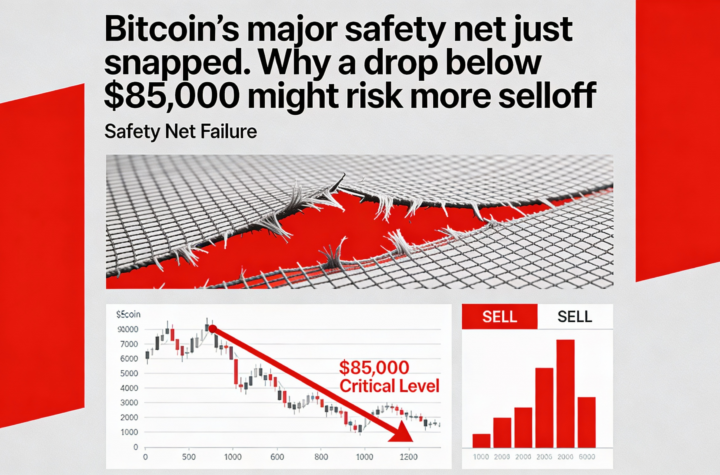

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

Crypto equities fall amid plunging spot volume and Bitcoin slipping under $84K

Dogecoin falls 7% as Bitcoin volatility spurs caution among memecoin traders.