Bernstein: SEC’s ‘Project Crypto’ May Redefine U.S. Digital Asset Regulation Despite Market Turmoil

While Friday’s sharp crypto market selloff captured headlines, a potentially pivotal regulatory shift may have gone unnoticed, according to a new research report from brokerage firm Bernstein.

In what analysts described as the most forward-looking crypto framework ever proposed by a sitting SEC chair, U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins unveiled “Project Crypto” — a wide-reaching plan to update the country’s securities laws to reflect the realities of the digital asset economy.

Atkins’ speech marked a clear break from the SEC’s historical stance, signaling that the agency intends to take an active role in fostering domestic crypto innovation rather than driving it offshore.

A Vision for Modernization

At the heart of Project Crypto is a push to “reshore” the crypto industry, reversing the effects of years of regulatory uncertainty that sent many digital asset businesses overseas. The SEC plans to leverage its interpretive and exemptive authorities to modernize outdated frameworks that Bernstein says have long “stifled entrepreneurship and innovation.”

In a dramatic shift from past messaging, Atkins said the majority of crypto assets should not be classified as securities. He criticized the overreliance on the Howey Test, which has been a source of confusion for both startups and investors, and promised new standards to better define categories such as commodities, stablecoins, collectibles, and governance tokens.

Building a Tokenized Market Infrastructure

Beyond classification, the initiative lays the foundation for domestic tokenization of traditional financial assets, including stocks and bonds. Bernstein said the SEC’s ultimate goal appears to be the development of the largest tokenized securities market globally — based in the U.S..

The proposal already has the attention of major Wall Street institutions and tech players, according to the report, suggesting strong momentum behind the plan.

While the broader crypto market remains under pressure, Bernstein believes Project Crypto represents a historic regulatory inflection point — one that could reshape U.S. capital markets and position the country as a global leader in blockchain-based financial infrastructure.

More Stories

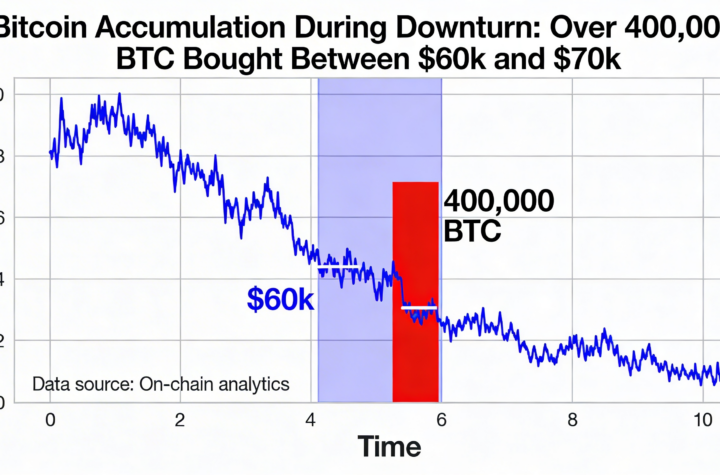

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

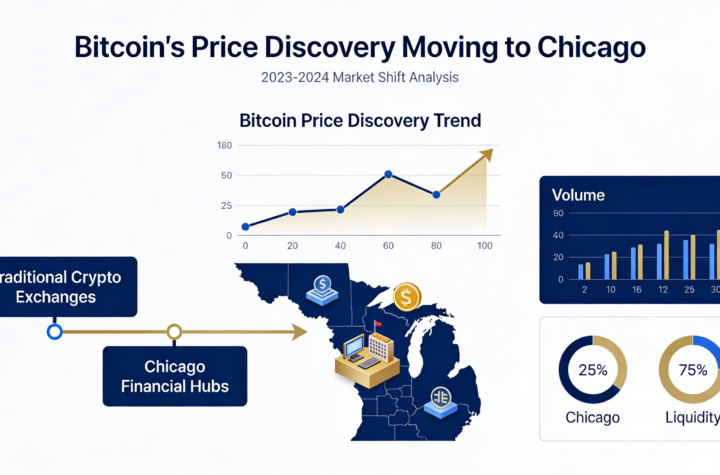

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago