JPMorgan: Ethereum’s Upgrades Have Yet to Spur Significant Network Growth

Despite recent network upgrades, Ethereum has not seen a meaningful rise in its core usage metrics, according to a report from investment bank JPMorgan.

The research, led by analyst Nikolaos Panigirtzoglou, notes that neither the daily transaction count nor the number of active addresses has increased substantially following the implementation of the Dencun and Pectra upgrades.

JPMorgan did observe a moderate increase in total value locked (TVL) between March 2024’s Dencun upgrade and the Pectra update in early May. This uptick is largely attributed to increased lending and borrowing activities on decentralized exchanges, although the growth in dollar terms lags behind the rise in Ethereum’s native token, ETH.

The Pectra upgrade, activated on May 7, targets improvements in staking efficiency, wallet functionality, and network performance. These changes aim to make Ethereum more appealing to institutional investors and enhance its competitive positioning. Yet, despite these enhancements, network activity has remained relatively stagnant.

Following Dencun, the network saw a drop in average and total fees, partly driven by a shift towards layer 2 scaling solutions. Additionally, the circulating supply of ETH increased post-upgrade, sparking concerns over inflationary pressures amid subdued transaction volumes.

Futures market data indicate that institutional investors have been a significant driver behind ETH’s recent price surge, which has climbed over 45% in the past month, according to CoinDesk.

More Stories

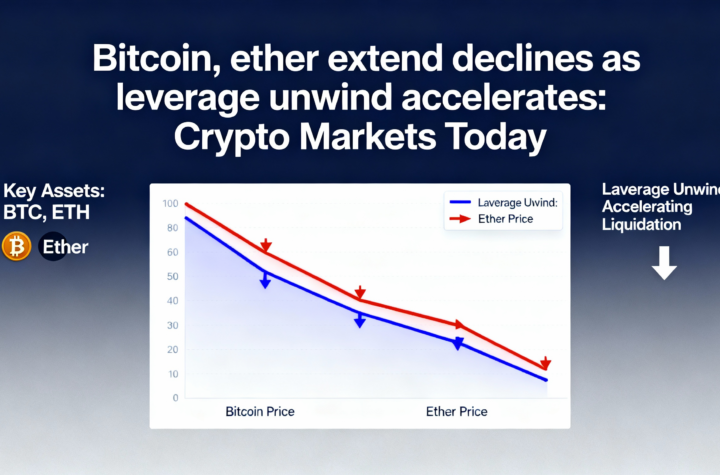

Anatomy of BTC’s selloff: the dollar’s bottom marked bitcoin’s top.

Silver plunges 35% and gold slides 12% amid a metals selloff, with bitcoin holding firm at $83,000.

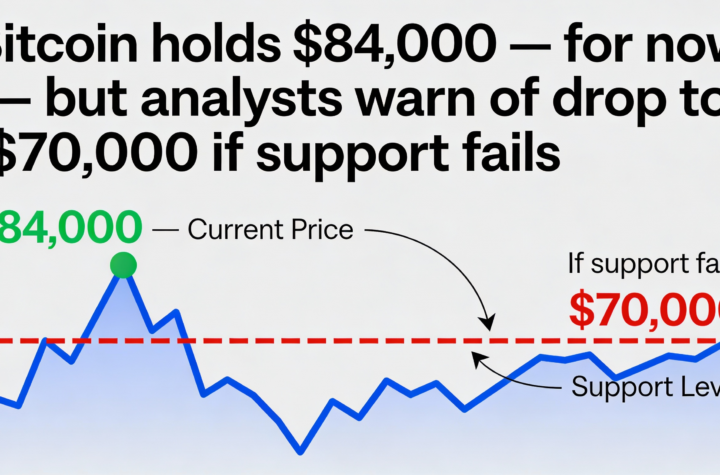

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.