NEAR Protocol Gains Momentum as Institutional Buyers Step In, Rises 8% from Key Support

NEAR Protocol displayed strong buying interest in the 23-hour trading period from July 30 to July 31, recovering from a low of $2.52 to close at $2.73, marking an 8.27% surge driven by institutional demand.

The price dip on July 30, between 18:00 and 19:00 UTC, saw NEAR fall from $2.68 to $2.52 on heavy volume of 9.6 million shares traded. This created a critical support level that institutional traders defended with consistent accumulation overnight.

In the final hour on July 31 (09:05–10:04 UTC), NEAR broke above the $2.725 resistance level with sustained volume above 28,000 shares per transaction. Key buying points at 09:17, 09:25, 09:52, and 10:01 reflect coordinated efforts by large investors positioning for the protocol’s growth potential in enterprise blockchain applications.

Analysts view NEAR’s rebound as part of a broader institutional trend favoring Layer 1 blockchains with strong enterprise use cases.

Key Technical Takeaways:

- Trading range: Support at $2.52, resistance near $2.74, showing 7.83% price volatility

- Volume surge: 9.6 million shares during the July 30 selloff

- Institutional accumulation zone identified between $2.52 and $2.55

- Final hour gains: 0.15%, with multiple high-volume buying spikes

- Resistance at $2.725 cleared decisively

- Net session increase of 2.87% over 23 hours

- Total institutional-driven rebound of 8.27% from support

More Stories

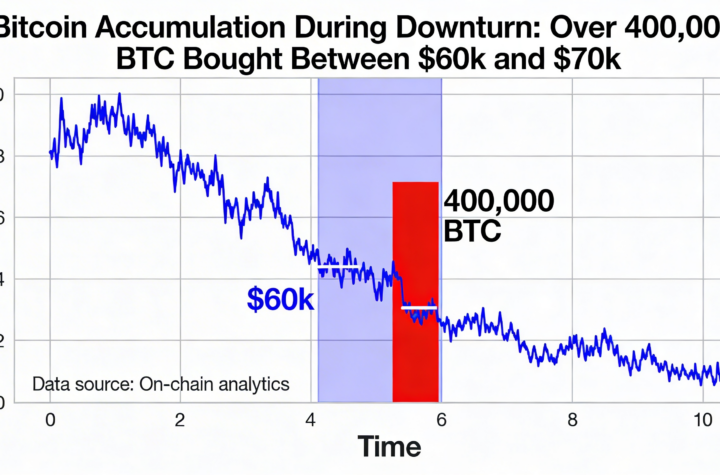

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

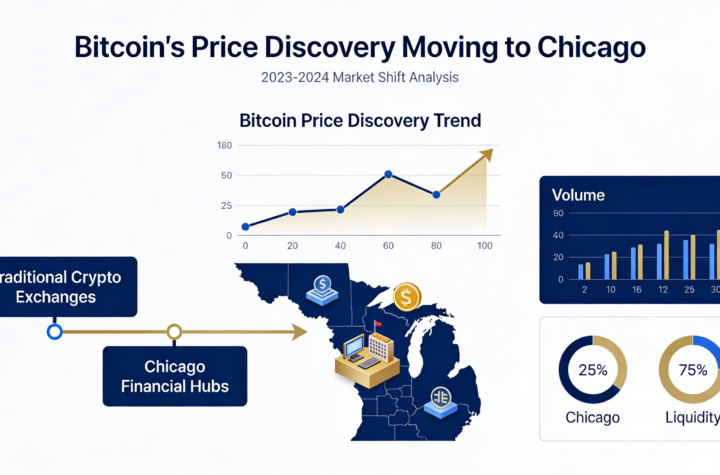

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago