Norway’s sovereign wealth fund, Norges Bank Investment Management (NBIM), has reported a substantial increase in its indirect exposure to Bitcoin (BTC), reaching $356.7 million by the close of 2024, according to K33 Research. This marks a 153% increase in Bitcoin holdings, rising from 1,507 BTC to 3,821 BTC in just one year.

This increase reflects the fund’s growing indirect Bitcoin exposure, which has surged from just 796 BTC in 2020. In addition to Bitcoin, NBIM also holds significant stakes in several crypto-related public companies. As of 2024, it owns a 0.72% stake in MicroStrategy (MSTR) valued at $500 million, a 1.1% stake in Tesla (TSLA), and shares in Coinbase (COIN), Metaplanet (3350), and MARA Holdings (MARA).

Known as the Government Pension Fund Global, NBIM is funded primarily by the revenue from Norway’s oil and gas industry. The fund achieved a record profit of $222.4 billion in 2024, driven largely by the boom in artificial intelligence (AI) investments.

K33 analyst Vetle Lunde attributes the increase in Bitcoin exposure to the sector-weighted nature of NBIM’s portfolio. As the value of crypto-linked assets appreciates, their share of the fund’s overall portfolio increases, leading to higher Bitcoin exposure over time.

More Stories

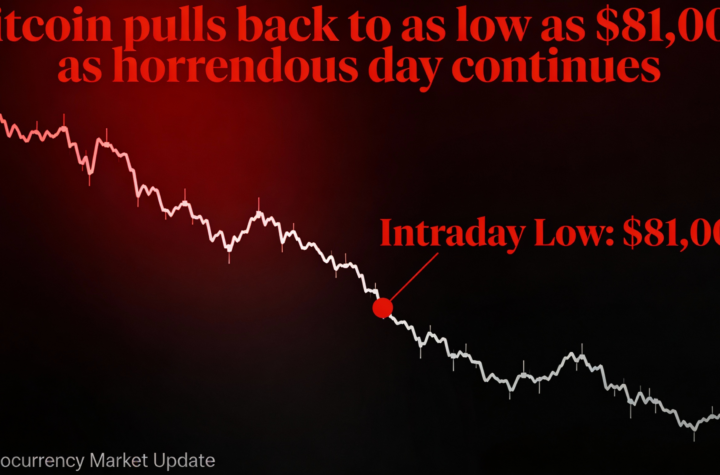

Bitcoin fell to around $81,000 as the selloff deepened during a rough day for markets.

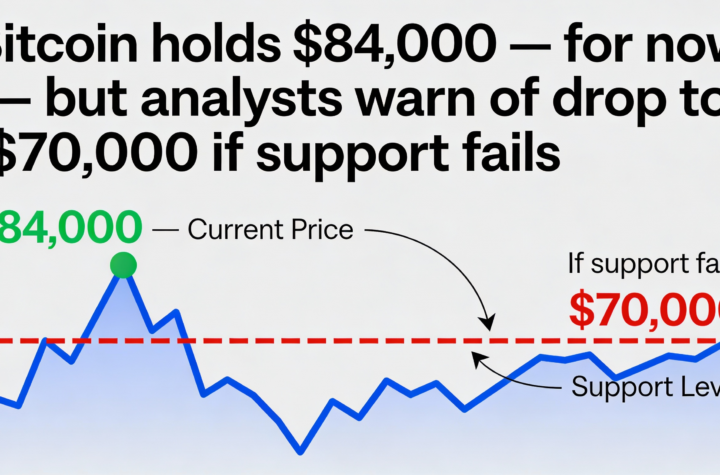

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

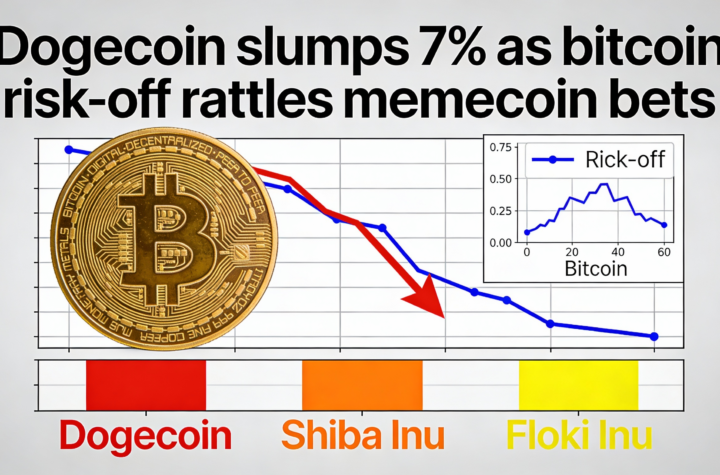

Crypto equities fall amid plunging spot volume and Bitcoin slipping under $84K