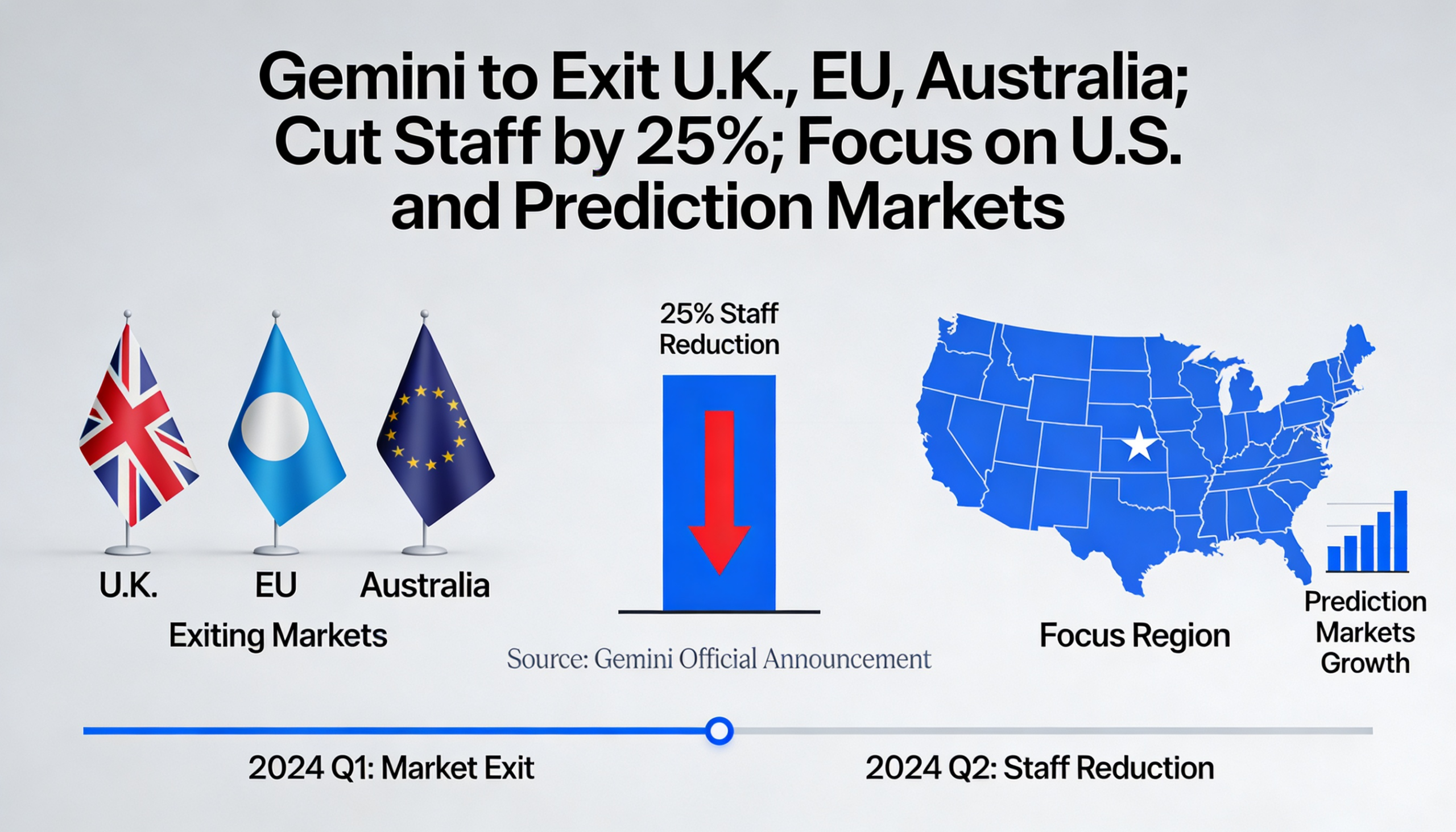

Gemini Space Station Inc. (GEMI) is exiting the U.K., European Union, and Australian markets while reducing its workforce by 25%, shifting focus to U.S. operations and prediction markets.

In a blog post Thursday, the New York-based crypto exchange outlined its offboarding plan, asking affected customers to register with brokerage platform eToro by the end of March to facilitate withdrawals. New accounts and deposits in these regions have been suspended, with full account closures scheduled for April.

“Effective 6 April 2026, Gemini will be ceasing operations in the United Kingdom,” the company said in an email to customers reviewed by CoinDesk. Accounts in these regions will enter withdrawal mode starting 5 March 2026. Gemini is partnering with eToro to assist users in transferring their assets.

Co-founders Tyler and Cameron Winklevoss cited challenges in gaining traction outside the U.S. as the main reason for the pullback. “America has the world’s greatest capital markets and has always been where it’s at for Gemini,” they said. “It’s time to focus and double down on America.”

The duo also emphasized Gemini’s strategic pivot toward prediction markets, which they see as a potential growth sector rivaling traditional capital markets. Since launching Gemini Predictions in mid-December, the platform has attracted over 10,000 users who have traded more than $24 million. The company said securing a license to launch a dedicated prediction marketplace positions it as an early mover in the space.

Gemini’s move comes amid broader weakness in crypto-linked equities. While major stock indices have gained in early 2026, leading digital-asset stocks have declined, reflecting waning investor appetite and tighter liquidity. Gemini, which went public in September, has seen its shares fall about 23% since the start of 2025, with a 2.8% drop recorded Thursday.

More Stories

Bitcoin slips below $70,000 as crypto selloff intensifies ahead of the U.S. equity open.

Bitcoin rebounds above $71,000 as tech stock selloff eases.

Bhutan shifts bitcoin to trading firms and exchanges as BTC slides toward $70,000.