Hedge Funds Target Ether Basis Trade, Short $1.73B to Lock in Yield

Hedge funds are increasingly shorting ether (ETH) as the token trades near $3,000, taking advantage of basis trade opportunities that offer yields as high as 9.5% annually.

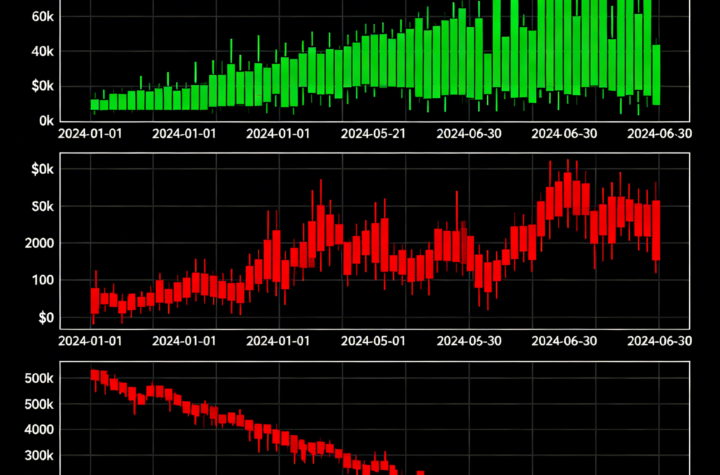

According to CFTC data cited by The Block, institutional traders have built $1.73 billion in short positions on the Chicago Mercantile Exchange (CME). Activity has heavily tilted toward the short side, with CME data—highlighted by the account zerohedge on X—showing a significant skew in net leveraged positioning.

The strategy, known as a basis trade, involves shorting futures on one venue (like CME) while buying spot ETH elsewhere—typically via ETFs—creating a delta-neutral setup. This allows traders to profit from the price difference between futures and spot without being exposed to directional moves.

Currently, the trade offers an attractive 9.5% annualized yield, driven by strong demand for ether ETFs, which now hold over $12 billion in assets. On Thursday alone, $421 million flowed into ETH ETFs, according to Coinglass, marking the largest single-day inflow on record and continuing a trend that began in early May.

Traders can potentially increase returns further by staking the ETH they purchase for an additional 3.5% annual yield. However, this option is not available to ETF holders, as fund providers retain custody of the tokens.

Bitcoin (BTC) was the dominant asset for basis trading throughout 2024, but collapsing yields in March dampened inflows and reduced price momentum. With ETH now offering more compelling returns, attention has clearly shifted.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%