Ether Rallies Over 20% as Spot ETFs Log Record $2.18B Weekly Inflows

Ether (ETH) saw a strong rally this past week, climbing more than 20% to briefly surpass $3,600 before settling near $3,560. The price surge was driven by renewed institutional demand and bullish momentum surrounding recent crypto-focused legislation in the U.S.

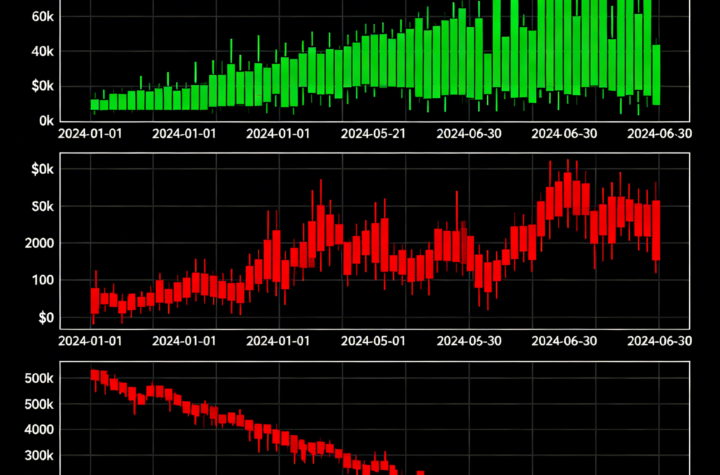

U.S.-listed spot Ethereum ETFs recorded their highest weekly inflow on record, pulling in $2.18 billion — the most since their launch a year ago. July 16 alone accounted for $726.74 million in net inflows, according to data from SoSoValue, marking the largest single-day influx to date.

Adding to the bullish signals, CME’s ether futures open interest hit a new all-time high, further highlighting institutional appetite for the world’s second-largest cryptocurrency.

The legislative catalyst behind the surge was the signing of the GENIUS Act, a newly enacted law that introduces tighter regulations for yield-bearing stablecoins. Analysts say the bill could push corporate treasuries toward native ETH staking solutions and more transparent restaking protocols.

Despite a modest weekend correction, ETH remains firmly above the $3,500 level, suggesting continued strength amid rising ETF activity and expanding institutional exposure.

More Stories

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%

Bitcoin Falls Under $66K While Oil Prices Jump Almost 20%