ETH Posts Strongest Monthly Rally Since 2022 Amid ETF Inflows, Corporate Accumulation

Ethereum’s native asset, ether (ETH), surged over 50% in July — its best monthly performance since mid-2022 — as investor momentum grew around spot ETF inflows and increasing institutional adoption.

ETH briefly touched $3,940 before pulling back below $3,800 to close the month. The last time ether saw gains of this scale was July 2022, when it rebounded from a steep market correction triggered by the collapse of Terra-Luna and other major crypto firms.

Unlike previous recoveries, this rally has been fueled by strong capital inflows rather than market rebounds. U.S.-listed spot ether ETFs recorded $5.4 billion in net inflows in July, marking their most active month since launching, according to SoSoValue data.

Institutional demand extended beyond ETFs. Corporations have added $6.2 billion worth of ETH to their treasuries, CEX.io data shows. While early movers like Bitmine (Tom Lee) and SharpLink (Joseph Lubin) led the charge, new entrants such as ETHZilla and Ether Machine have quickly raised substantial capital for ETH allocations.

The momentum coincides with growing attention on Ethereum’s infrastructure role in the digital dollar ecosystem. With over half of the $250 billion stablecoin market built on Ethereum and the recent passage of the Genius Act providing regulatory clarity, ETH is increasingly viewed as foundational to tokenization and stablecoin activity.

Despite the rally, ether faces significant resistance at the $4,000 level — a threshold it struggled to breach in previous attempts. Seasonal softness in August may also contribute to near-term consolidation.

Still, some analysts remain optimistic. Crypto investor Bob Loukas suggested ETH could extend its rally as high as $4,700, citing residual momentum and improving fundamentals.

More Stories

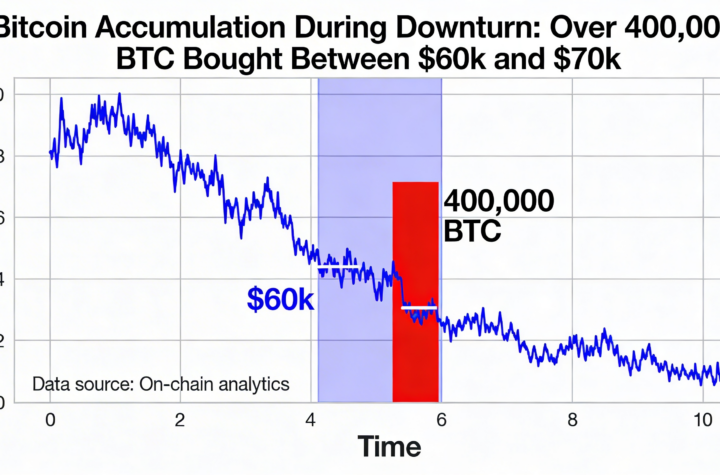

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone

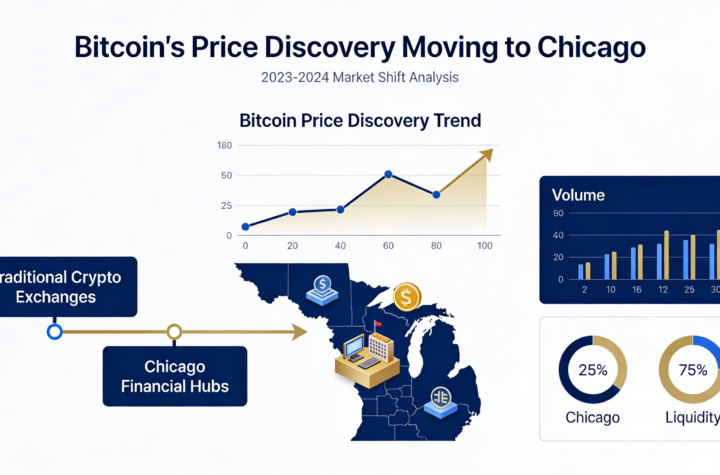

Bitcoin Trading Momentum Signals Price Discovery Migration to Chicago