XRP Drops Below $3 as SEC ETF Delays and Ledger Security Woes Weigh on Sentiment

XRP has fallen back under the $3 threshold after facing stiff resistance and renewed regulatory and security concerns. The U.S. Securities and Exchange Commission has pushed back its decision on several XRP ETF applications—most notably the Nasdaq-CoinShares filing—postponing potential approval until October.

At the same time, investor sentiment took a hit after a blockchain audit ranked the XRP Ledger last among 15 networks for security, raising fresh concerns about its suitability for institutional products.

Market Summary

- ETF Delay: The SEC deferred decisions on multiple XRP ETF filings, prolonging regulatory uncertainty.

- Security Concerns: A third-party audit ranking XRP Ledger the weakest in security among major chains triggered negative sentiment and risk reduction.

- Institutional Response: The twin shocks prompted large players to reduce exposure, fueling a wave of selling pressure.

Price Performance

- 24-Hour Move: XRP declined 4%, from $3.02 to $2.90, between Aug. 19 (06:00 UTC) and Aug. 20 (05:00 UTC).

- Intraday Action: The sharpest drop occurred between 13:00–15:00 UTC on Aug. 19, with price collapsing from $3.04 to $2.93.

- Volume Surge: Trading activity spiked to 137.18 million during the 14:00 UTC hour—nearly double the daily average of 71.23 million.

- Support Defense: Buyers stepped in near $2.85–$2.88 multiple times, helping XRP stabilize in the $2.89–$2.90 zone by session close.

Technical Outlook

- Resistance: $3.04 remains a key rejection level after a volume-driven pullback.

- Support Zone: Repeated defenses at $2.85–$2.88 have so far prevented a deeper selloff.

- Consolidation: XRP is currently ranging between $2.89–$2.90, signaling temporary equilibrium after heavy selling.

- Volume Indicator: The spike in volume suggests institutional repositioning rather than retail-led volatility.

Looking Ahead

- $3.00 Retest: Markets are watching closely to see if XRP can flip $3.00 back into support.

- Institutional Positioning: Trading flows near the $2.85–$2.90 level may reveal whether large players view this as a buying opportunity.

- October Decisions: SEC rulings will likely dictate medium-term price direction and volatility.

- Security Concerns: Continued scrutiny of the XRP Ledger’s technical integrity could influence ETF approval prospects and institutional adoption.

More Stories

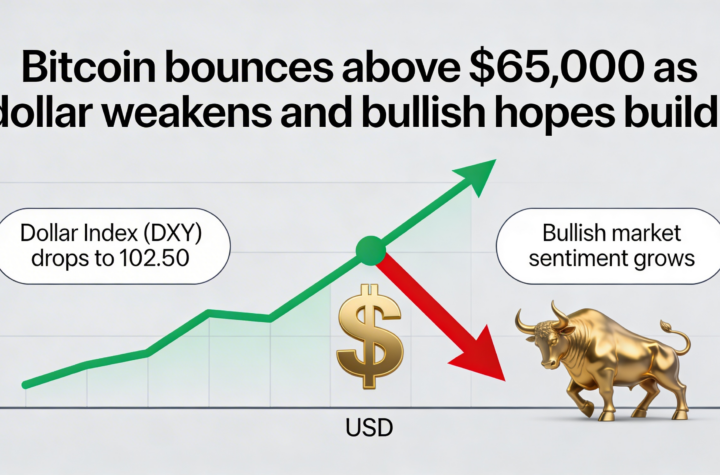

Bitcoin pushes past $65,000 as dollar strength fades and bullish sentiment strengthens.

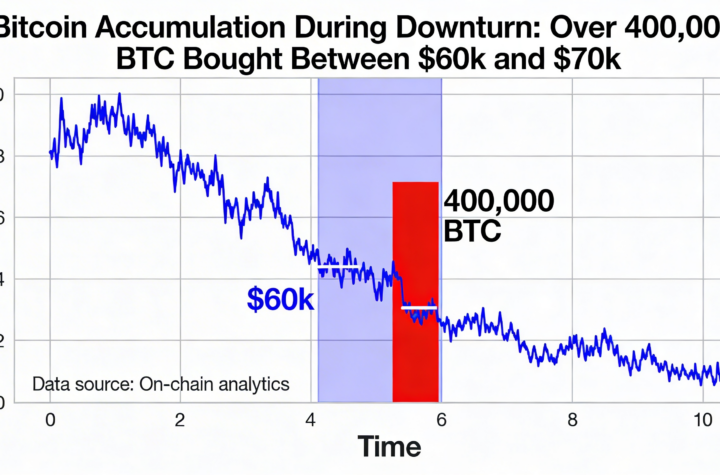

Over 400K Bitcoin purchased as prices hovered between $60K and $70K in the recent sell-off

Broad Crypto Sell-Off Deepens While Bitcoin Trades Near Critical Liquidation Zone