Dogecoin climbed alongside the broader crypto market on Thursday, but a wave of profit-taking erased nearly all of its intraday gains.

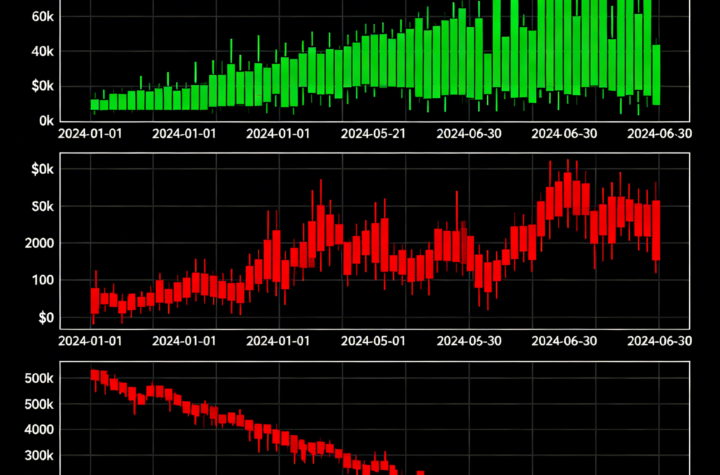

Between July 11 at 06:00 and July 12 at 05:00, DOGE advanced 8.6%, rallying from $0.198 to as high as $0.213 before closing the session back at $0.202—a full retracement of the move.

Trading volumes soared past 1.1 billion during the busiest window between 13:00 and 15:00, with resistance emerging in the $0.208–$0.213 range. Even as volatility picked up in the final hours, buyers defended support at $0.200–$0.201, and prices stabilized near $0.202 into the close.

Analysts pointed to the sharp rejection near $0.211 around 20:00 as evidence of coordinated selling by larger holders locking in profits.

News Context: Bitcoin Records and Risk-On Appetite Fuel Rally

Bitcoin hit an all-time high of $118,000 during the session, with crypto markets buoyed by a surge of institutional inflows estimated at $50 billion this week alone.

Easing geopolitical tensions, improving trade dynamics, and dovish central bank signals have fueled a broader appetite for risk assets. Dogecoin, known for its high-beta swings during crypto rallies, spiked along with other altcoins.

Price Action Recap

- Range: $0.198 low → $0.213 high → $0.202 close (8.6% swing)

- Breakout: Cleared $0.200–$0.208 on heavy volume

- Resistance Zone: $0.208–$0.213; reversal occurred at $0.211

- Support: Tested and held repeatedly at $0.200–$0.201

- Final Hour: Price edged up from $0.200 to $0.202 (+0.5%)

- Volume Peaks: 1.1B during 13:00–15:00, plus 19M during the late-session push

Technical View

- Mid-session momentum broke through initial resistance but stalled below $0.213

- The volume-backed rejection near the high suggests strategic profit-taking by institutions

- A modest recovery in the final hour highlights $0.200 as a psychologically important level

- Momentum is cooling, and near-term consolidation is likely in the $0.200–$0.204 range

Key Questions for Traders

- Can DOGE reclaim and hold above $0.208–$0.210 to attempt a retest of recent highs?

- A breakdown below $0.198–$0.200 would indicate fading bullish momentum

- Sustained consolidation above $0.202 would strengthen the setup for another push higher next week

- Broader Bitcoin trends and macro risk sentiment will remain major drivers of altcoin flows

Takeaway

Dogecoin’s rally mirrored the wider crypto surge, delivering a clean breakout before encountering stiff resistance at $0.213. The quick reversal underscores the vulnerability of meme coin rallies during periods of high volatility.

While institutional capital remains active, traders should wait for clear volume signals before chasing upside. For now, $0.200 is the critical support level to watch.

More Stories

Bitcoin Tops Stocks and Gold Amid Market Turmoil From Middle East Conflict

Bitcoin Gains Amid Oil Spike and Falling Stocks

Bitcoin Risks Deeper Declines With Odds of U.S. Market Crash Rising to 35%