Traders at Singapore-based QCP Capital attributed a recent market crash to overly bullish sentiment, rather than solely blaming the Federal Reserve’s hawkish stance. In a Friday note, QCP traders stated, “We believe the root cause of the morning’s crash to be the market’s overly bullish positioning.”

Losses in major cryptocurrencies, including Bitcoin (BTC), extended for a third consecutive day as risk-off sentiment following this week’s FOMC meeting and general profit-taking weighed heavily on the market. BTC fell 4.2% over the past 24 hours, while Solana’s SOL, Ether (ETH), and Cardano’s ADA saw declines of up to 9%. Dogecoin experienced the sharpest drop, sliding 11% and extending weekly losses beyond 21%.

The CoinDesk 20 (CD20) index, representing the largest tokens by market cap, fell 5.5%. Futures markets mirrored this sentiment, with over $890 million in long and short positions liquidated in the past day.

The market reaction followed a hawkish tone from the Federal Reserve. On Wednesday and Thursday, risk assets, including Nasdaq and S&P 500, fell sharply by 3.5% and 2.9%, respectively. BTC also dropped more than 6% after Fed Chair Jerome Powell indicated only two rate cuts are expected in 2025, contrary to market expectations of three.

Despite the downturn, historical trends suggest December often proves bullish for Bitcoin, a phenomenon known as the ‘Santa Claus Rally.’ Over the past eight years, Bitcoin has closed December in the green six times since 2015, with gains ranging from 8% to a remarkable 46% in 2020.

Seasonality plays a key role in market behavior, with recurring trends often tied to factors such as tax-related profit-taking in April and May or increased investment activity during the holiday season in November and December.

Another example of market seasonality is the ‘January Effect,’ where asset prices, including cryptocurrencies, often experience an uptick at the start of the year. This trend is attributed to increased investor confidence, fresh capital inflows, and portfolio rebalancing after year-end tax-loss harvesting.

Additionally, the ‘Sell in May and Go Away’ phenomenon highlights another seasonal trend where markets, including cryptocurrency, tend to experience lower returns during the summer months. Historically, investors reduce their exposure to risk assets in May, anticipating slower market activity and increased volatility during the summer period.

More Stories

Bitcoin rises above $87,000 while the yen weakens after Japan raises interest rates.

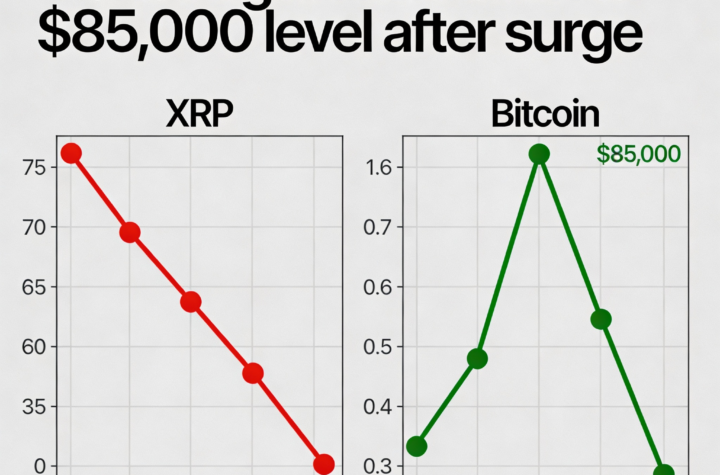

XRP falls alongside Bitcoin, which drops back to $85,000 after a surge.

Fidelity director flips bearish, flags risk of year-long downturn for crypto