Crypto Markets Slide Amid Fed Hold and Risk-Off Sentiment

Even though the Federal Reserve’s decision to keep interest rates at 3.5%-3.75% was widely expected, rising geopolitical tensions and a rotation into safe-haven assets left crypto traders in the red.

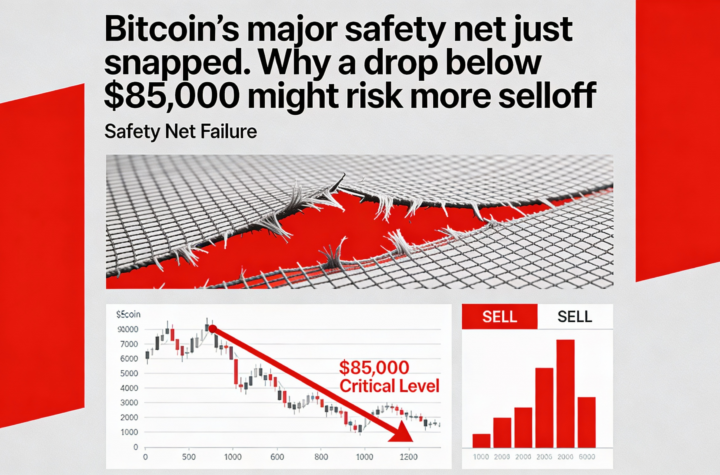

Bitcoin BTC $82,550.64 fell back toward $88,000 as risk-off sentiment swept through global markets. U.S. stocks showed mixed performance, with the S&P 500 briefly topping 7,000 before pulling back amid earnings reports from major companies.

Crypto, however, bore the brunt of the sell-off. The CoinDesk 20 (CD20) index dropped 2.9%, while gold surged above $5,500 an ounce, lifting gold-backed tokens like XAUT $4,897.90 amid aggressive accumulation by Tether and central banks. Silver also rose to $117 an ounce. Despite the U.S. Dollar Index (DXY) hitting a four-year low, bitcoin continues to behave more like a liquidity-sensitive risk asset than a traditional hedge.

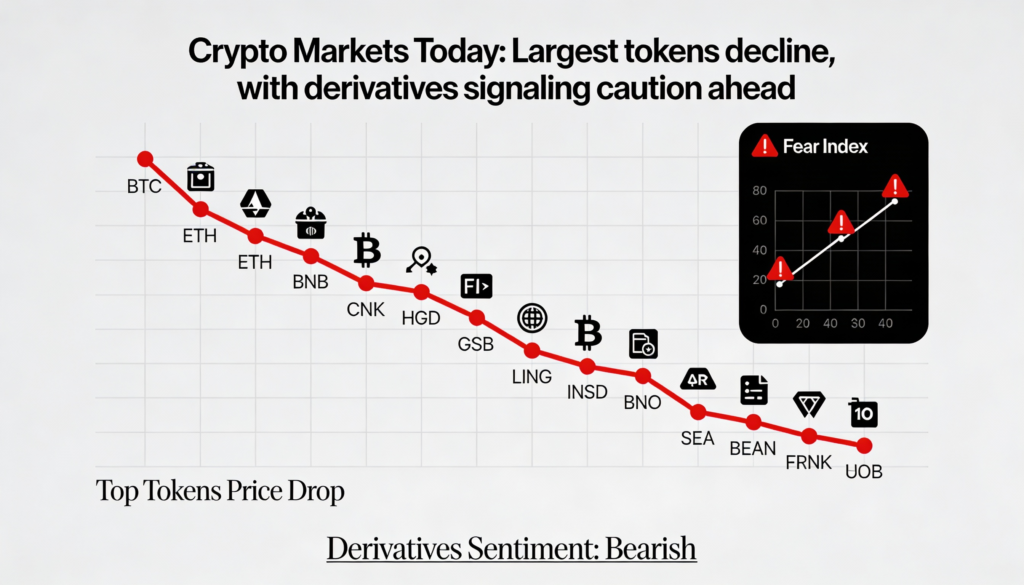

Derivatives Signals

- Total crypto futures open interest fell nearly 3% to $132.26 billion, signaling increased caution.

- $348.3 million in futures were liquidated over 24 hours, mostly long positions.

- BTC and ETH 30-day implied volatility remains near multimonth lows, indicating expectations of calmer conditions.

- Perpetual funding rates for major tokens are near zero, down from 10% earlier this week; XLM funding has turned negative.

- Deribit options show BTC and ETH puts at a premium to calls, reflecting cautious sentiment.

Token News

- Optimism’s community approved a 12-month plan to buy back OP tokens using network revenue. Over 84% of votes supported the measure. Pending final approval, ETH from sequencer fees will be converted into OP starting February.

- Half of the Superchain’s $17 million revenue last year will fund monthly token purchases. The Superchain includes chains such as Coinbase’s Base and World Chain.

- OP’s price has dropped 80% over the past year and fell another 5% in the last 24 hours, trading below 29 cents.

More Stories

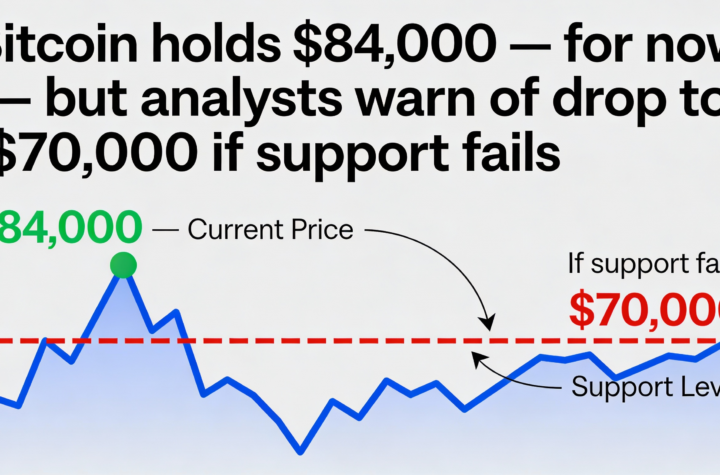

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

Crypto equities fall amid plunging spot volume and Bitcoin slipping under $84K

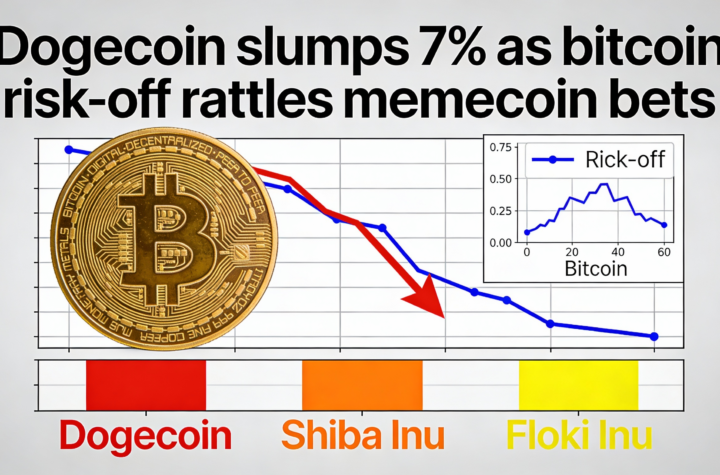

Dogecoin falls 7% as Bitcoin volatility spurs caution among memecoin traders.