Crypto Exchange Stocks Slide as Bitcoin Dips Below $84K

Crypto exchange stocks extended their January losses on Thursday as Bitcoin fell 6% below $84,000, fueling market caution. Coinbase (COIN), the largest publicly traded crypto firm, dropped 7% on the day and is down 17% year-to-date. The move marks its eighth consecutive losing session, the longest streak since September 2024, bringing its price back to May 2025 levels at $195.

Other crypto exchanges also struggled. Gemini (GEMI) fell 8% Thursday and 21% year-to-date, while Bullish (BLSH) and Circle (CRCL) are down 16% and 20% in 2026. The declines come amid falling crypto prices and declining spot trading volumes, which totaled $900 billion in January—roughly half the $1.7 trillion recorded a year earlier, according to TheTie.

“Bitcoin has been hovering around $85,000, and the market is clearly hesitant,” said Eric He, Community Angel Officer and Risk Control Adviser at LBank. “Geopolitical tensions are keeping investors cautious, and that’s affecting all assets, not just crypto. While stocks and commodities move higher, crypto remains in a wait-and-see mode.”

AI Diversification Supports Some Firms

Not all crypto companies are struggling. Bitcoin miners repurposing energy and computing resources for AI workloads have performed better, despite the selloff. Hut 8 (HUT), IREN (IREN), CleanSpark (CLSK), and Cipher Mining (CIFR) are posting year-to-date gains.

Galaxy Digital (GLXY), led by Mike Novogratz, has also benefited from its pivot into data centers, driving strong 2026 performance despite Thursday’s pullback.

More Stories

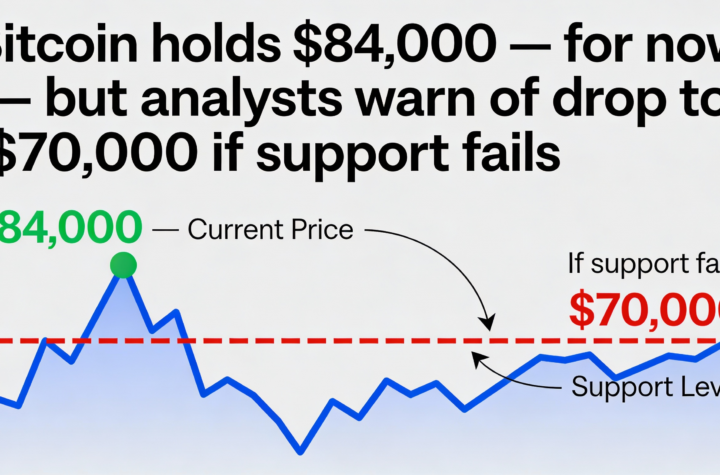

Bitcoin steadies near $84K, but a loss of support could open the door to $70,000.

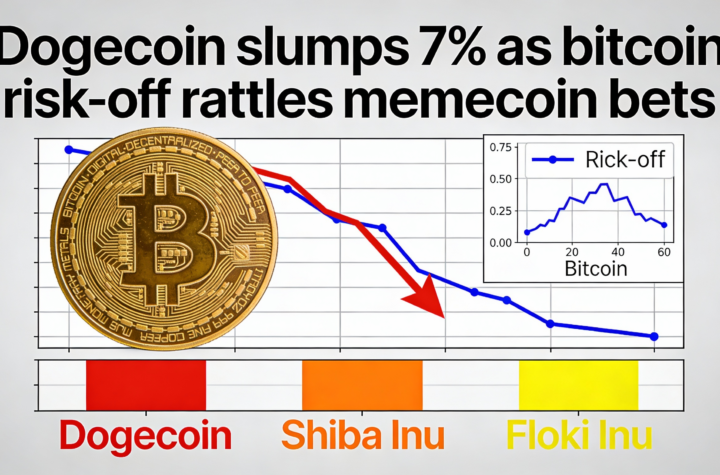

Dogecoin falls 7% as Bitcoin volatility spurs caution among memecoin traders.

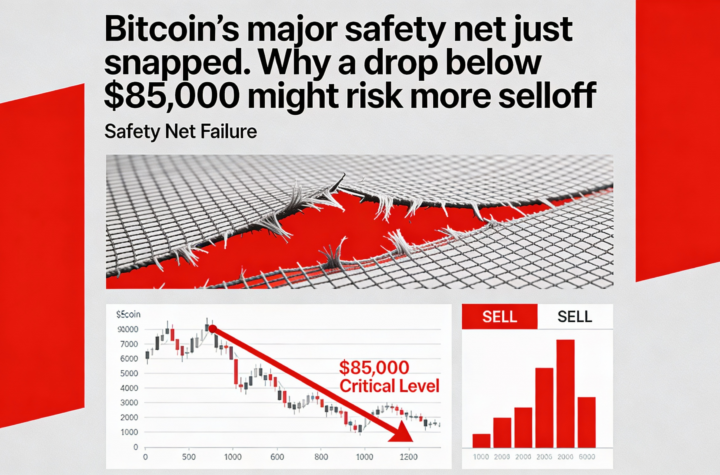

The major safety net for BTC is gone; a drop under $85,000 may spark additional selling